Find the best savings app for your financial goals

When you work for yourself, one of the biggest challenges can be riding out moments of uncertainty when work is slow or you have a big, unexpected expense. Finding the best savings app can help you to build up at least 6 months worth of expenses to prepare for these moments, so you can get through them stress-free. But when it feels like you’re putting every penny back into your business or toward your expenses, how do you find any change left over to save for the future?

Some new apps can take the pain out of savings by saving such a small amount at a time that you don’t even notice it’s missing from your checking account. That way it doesn’t feel like a major sacrifice. Believe it or not, those small amounts can add up to a lot over time – even more if you’re investing that money. But how do you know which app is right for you? Each of these apps has different advantages, depending on your savings goals.

Best savings app for the short term: Digit

After you link your bank account, Digit watches your spending habits and adjusts how much it moves into your savings accounts based on how much you’re spending at a given moment. It may sound counterintuitive, but Digit will actually save larger amounts when it notices you’re spending more money. That’s because if you’re already making some large purchases, you’re less likely to “feel” it when a larger amount is moved to savings. On the other hand, when you’re spending very little, moving a relatively large amount to savings will feel like a big hit. With Digit’s “No Overdraft Guarantee” there’s no need to worry about the app moving more money than you can afford. Digit has a simple chatbot interface that can take some getting used to – instead of a menu of frequent actions, you essentially text those actions to the bot, whether you want to see your recent activity, make a withdrawal, set a new goal, etc.

Available for: iOS and Android

Cost: $2.99/month after free 100 day trial period

Bonus: 1% Savings Bonus every 3 months

Best for: Digit is great for entry level savings to build up your rainy day fun, save for a vacation, or pay off debt. The relatively low return (1% bonus) isn’t great for long term savings.

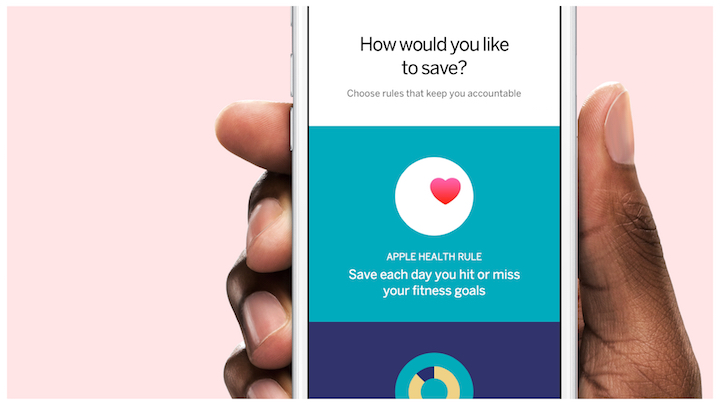

Best savings app for forming good habits: Qapital

What if an app could not only make saving painless, but help you use your daily habits to grow your savings too? Qapital tries to do just this, by offering a few different rules you can set to determine when the app moves money to your savings. The simple Round Up rule moves the additional change from rounding up every purchase on your linked bank card into savings. But you can also use IFTTT (If This Then That) to set up other apps you use frequently to trigger deposits. So you can use the habits you do (or would like to do) every day to grow your savings, like every time you post to Instagram with a specific hashtag, hit your steps goal, or indulge in your guilty pleasure (hello mocha latte!). Qapital’s smartest rule may be the Spend Less rule though. This let’s you challenge yourself to spend less than a certain amount at one place, and if you succeed the remainder will be transferred to savings.

Here’s the downside: Unlike a traditional bank savings account, you don’t accrue any interest on the money you save with Qapital. Qapital keeps the interest it makes from the banks holding your savings, that’s how they keep the app free for you.

Available for: iOS and Android

Cost: Free

Bonus: Train your brain to associate certain activities with saving

Best for: Building up short term savings and improving your spending habits, which could help improve your financial situation long term. As your savings grows though, that small

Best savings app for the long term: Acorns

Acorns requires you to link your debit or credit card. It then rounds up each of your purchases to the nearest dollar amount and invests that change in a stock portfolio. You’ll answer a few simple questions about your financial situation and goals and Acorns will recommend an investment portfolio for you. Keep in mind it’s a pretty basic recommendation. The longer you plan to wait to use your funds, the riskier a portfolio the app will likely recommend, since you have more time to ride out the market’s highs and lows. When you have the extra cash, you can also boost your account any time with one-time deposits or set up recurring investments.

Acorns is sort of a hybrid savings and investing app. But the big difference to watch out for is that while investment accounts offer the potential to grow your funds through higher returns, they also carry more risk than a savings account because the markets can also cause you to lose your money. In the long term, markets tend to go up. But if you think you’ll want to use this money soon, investing may not be right for you.

Available for: iOS and Andoroid

Cost: Accounts under $5,000 pay $1 per month. For accounts of $5,000 or more, pay 0.25% per year. Free for college students (with a .edu address).

Bonus: Through Acorn’s “Found Money” program, certain partner brands like Airbnb, Nike, and Hulu, will invest additional money for you when you shop with them.

Best for: Acorns is a great way to start investing without a high initial deposit or expensive financial manager fees. Investment accounts typically have better returns than bank savings accounts, but since markets fluctuate often, you have to leave the money in the account longer to see the pay off.