The Ultimate Guide to Taxes for Postmates

Filing taxes as a Postmate might seem overwhelming at first, but Stride is here to answer all of your questions and to make it as simple as possible. Keep reading for answers to the most common questions we get from the Postmates Fleet, ranging from general questions on filing down to the details about deductions and tracking and record-keeping.

If you want to learn more about how to save money on your taxes, be sure to watch our webinar for Postmates, where we go over:

Mileage and tax deductions, and how to lower your tax bill

How to report 1099 income as an independent contractor

Overview of the services and benefits Stride offers

Table of Contents

General Filing Questions

What type of records are needed to report mileage for deliveries?

Can Stride provide a template spreadsheet for tracking expenses?

Do I need to file separate “Schedule C” forms if I work for more than one app?

Deductions

What kind of expenses can I deduct as an independent contractor?

What about tolls, vehicle maintenance, payments, insurance, and other vehicle-related expenses?

Tracking and Record-Keeping

How do I track miles and what records do I need as evidence of mileage for deliveries?

How do I account for miles from the pickup location to the dropoff location?

General Filing Questions from Postmates

1. How do I file taxes as an independent contractor?

There are a ton of tax filing options available to you, and they come at varying costs.

While Stride doesn't offer tax preparation services, Stride members can get 25 percent off federal filing with TurboTax® Self-Employed products. If you’re not already a member, you can sign up now to get your savings. If you’re already a member, sign in.

You can choose to file on your own or you can take advantage of their Tax Pro Go remote filing service that starts at $49. You'll upload all of your tax information and a tax preparer will use those documents to file for you.

Other online tax filing softwares range in price, from free filing through Credit Karma Tax all the way to TurboTax Self-Employed for a little over $100.

There are also a number of free tax preparation nonprofits that will help you at no charge, depending on your income. You can read more about some of these free programs here.

If you know you have a complicated tax return and are willing to spend a little extra for a tax preparer or CPA, then you could hire a licensed tax preparer. For one of these individuals (like a CPA, tax attorney, or EA), you’ll typically pay between $100 and $450 per hour.

Stride has a more comprehensive list of options here if you'd like to read more.

2. What type of records are needed to report mileage for deliveries?

You can use the Stride app to record your business expenses and business mileage — that’s all you need! Your Stride mileage log can serve as sufficient evidence that you drove those miles for work. The app will put that information into an IRS-ready tax report format. You'll use this report when you file your taxes in order to claim your business expenses.

If you don’t have our app, you can get it here: postmates.stridehealth.com/join.

3. When can we start the tax filing process during the year?

We recommend starting your tax filing preparation as soon as you’ve gathered all of your tax information for 2022, including your income and expense records. It’s usually advantageous to file as soon as you can, so that if you’re owed a tax refund, you can get it as soon as possible.

Postmates will only prepare a 1099-NEC for you if your earnings exceed $600 in a year.

According to Postmates, if you don't meet this requirement, you won't receive a 1099-NEC. Fortunately, you can still file your taxes without it. Regardless of whether or not you receive a 1099-NEC, you must still file taxes with the IRS.

If you need help determining how much you’ve made in 2022 and did not receive a 1099, you can refer back to your Weekly Pay Statements sent via email.

For further information on how to find your Postmates 1099 information, visit Postmates’ support page: Postmates Fleet Support.

4. Can Stride provide a template spreadsheet for tracking expenses?

Yes — you can export your reports directly from the Stride app.

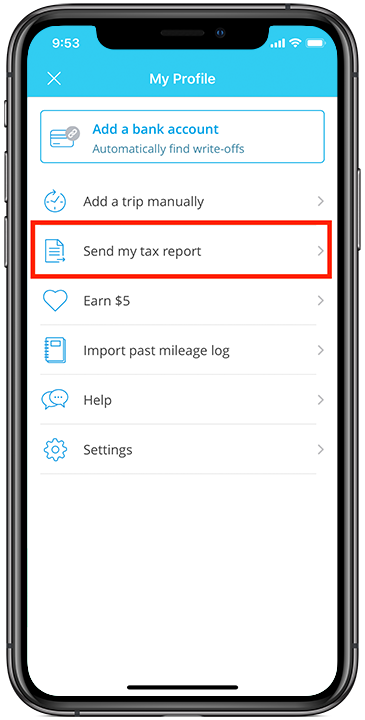

If you navigate to the menu of your app (on the top left hand corner of your screen), you'll see the option to "Send my tax report." Once you click this button, your deduction information will be emailed to you. You’ll receive 3 reports:

A spreadsheet that lists all of your saved expenses

A mileage log

A PDF summary that totals all of your expenses and mileage information, which you can easily use when you file your taxes.

The reports are free, and you can export updated records as often as you'd like.

If you don’t have our app, you can get it here: postmates.stridehealth.com/join.

5. What are quarterly taxes? Am I supposed to pay them?

The IRS expects you to pay taxes quarterly if you will owe $1,000 or more in taxes for a given year, and if those taxes are not already being taken out of your paycheck. Because taxes aren’t withheld from your Postmates income, it’s possible you need to pay taxes quarterly.

The best way to figure out if you owe quarterly taxes is to fill out Form 1040-ES, or use an online tax calculator to estimate how much income you’ll have this year and how much you’ll owe in taxes. If you find that you’ll owe more than $1,000 in taxes that are not being withheld from a paycheck, then you’ll know you need to pay quarterly taxes. If you do, then you can pay them directly on the IRS website here.

Have more questions about quarterly taxes? You can use Stride’s quarterly tax guide here!

6. Do I need to file separate “Schedule C” forms if I work for more than one app?

A separate Schedule C is needed to file for each business category. However, you can use the same Schedule C form if you are using apps that are in the same industry (like two delivery apps).

Deductions for Postmates

1. How do I track tax deductions in the Stride app?

To start recording your mileage or other expenses, you can press the green "+" button on your Tax Savings screen in the app, then click "Track my miles." If you’d like to record a business expense, you can click “What else can I write off?”

2. What kind of expenses can I deduct as an independent contractor?

In addition to deducting your vehicle expenses (like your mileage), you can also deduct many other business expenses.

If you incur a business-related expense, then it’s deductible. There are many business expenses that are considered “ordinary and necessary” for running a delivery business. You can find a complete list of them here.

A few of them include:

A portion of your cell phone bill

Vehicle expenses

Hot bags, blankets, and courier backpacks

Health insurance

Just be sure to only deduct the portion of these expenses that are for your business, not for personal use. For example, if you use your cell phone for work 50 percent of the time, you would only deduct 50 percent of your phone costs.

3. What about tolls, vehicle maintenance, payments, insurance, and other vehicle-related expenses?

These are deductible as business expenses. However, if you deduct these vehicle expenses, then you can’t deduct your mileage; you can only deduct one or the other.

If you use your car for work, then you can deduct your car expenses in one of two ways:

Deduct a portion of your actual car expenses (like insurance, car payments, maintenance, gas, and registration fees). If you use your car for work 50 percent of the time, you’d deduct 50 percent of those expenses. This method can be a bit tedious, since you’ll need to keep track of all of your car expenses, but if you have higher-than-average car costs, then it can pay off.

Deduct your mileage. You can deduct a flat rate per business mile that you’ve driven. The 2023 mileage rate for business mileage is 65.5 cents per mile.

If you’re not sure which method is best for you, we recommend checking out our guide here, which can help you determine which method to use based on your situation.

4. What about my cell phone bill?

You would have to split the cost of your cell phone bill and only deduct the portion that’s used for business. So let’s say you use your cellphone for work 60 percent of the time in a given month, you deduct 60% of your monthly bill. Naturally, it is a bit tougher to find the business percentage of your cell phone bill.

The best way to do so is to take what you’d consider an average week or a month and go through your calls and texts in that week or month to figure out:

What percentage of your texts and calls were for work

What percentage of your data was used for work

When the phone is being used

How much of the time is it being used for work

If you use the business percentage that you’ve found for that week or month and apply it to your phone bill costs for the rest of the year, then you can save yourself a bunch of time figuring out what your percentage of your bill is deductible.

5. What about my bicycle-related expenses?

The standard mileage deduction is meant for the business use of an automobile and accounts for gas, insurance, and repairs. Unfortunately, you would not be able to deduct your bicycle miles in the same way that you deduct your car’s miles. However, you would be able to deduct a business use percentage of your bike purchase and maintenance costs.

Tracking and Record-Keeping for Postmates

1. How do I track miles and what records do I need as evidence of mileage for deliveries?

To start recording your mileage, you can press the green "+" button on your Tax Savings screen in the app, then click "Track my miles." (See screenshots in Question 1 in the “Deductions for Postmates” section above).

You can use Stride to record your business expenses and business mileage, that is all you need. It serves as sufficient evidence that you drove those miles for work. The app will put that information into an IRS-ready tax report format. You'll use this report when you file your taxes in order to claim your business expenses.

2. Which miles should I be tracking when I work for Postmates?

The mileage that you incur on your way to your first delivery and between deliveries is all deductible. As long as you’re online and accepting deliveries, then the miles that you drive will all be deductible.

We hope this guide helped answered all of your tax questions as a Postmate. If anything else comes up, be sure to reach out to our support team at support@stridehealth.com and they will help you out!

Limited time offer for TurboTax 2023. Discount applies to TurboTax federal products only. Actual prices are determined at the time of print or e-file and are subject to change without notice. Terms, conditions, features, availability, pricing, fees, service and support options subject to change without notice. Intuit, TurboTax and TurboTax Online, among others, are registered trademarks and/or service marks of Intuit Inc. in the United States and other countries.