Stride and Roadie Partner to Empower Drivers with Financial Tools

We’re teaming up with Roadie, a UPS Company and a logistics management and crowdsourced delivery platform, to provide comprehensive support to independent drivers nationwide.

Stride Launches Utah's First Independent Worker Portable Benefits Contributions Program

On the heels of last week’s exciting announcement, w’re launching the Stride Contributions program in Utah, following the state’s passage of new Portable Benefit Plan legislation (SB-233), which creates opportunities for companies to extend more benefits to 1099 workers.

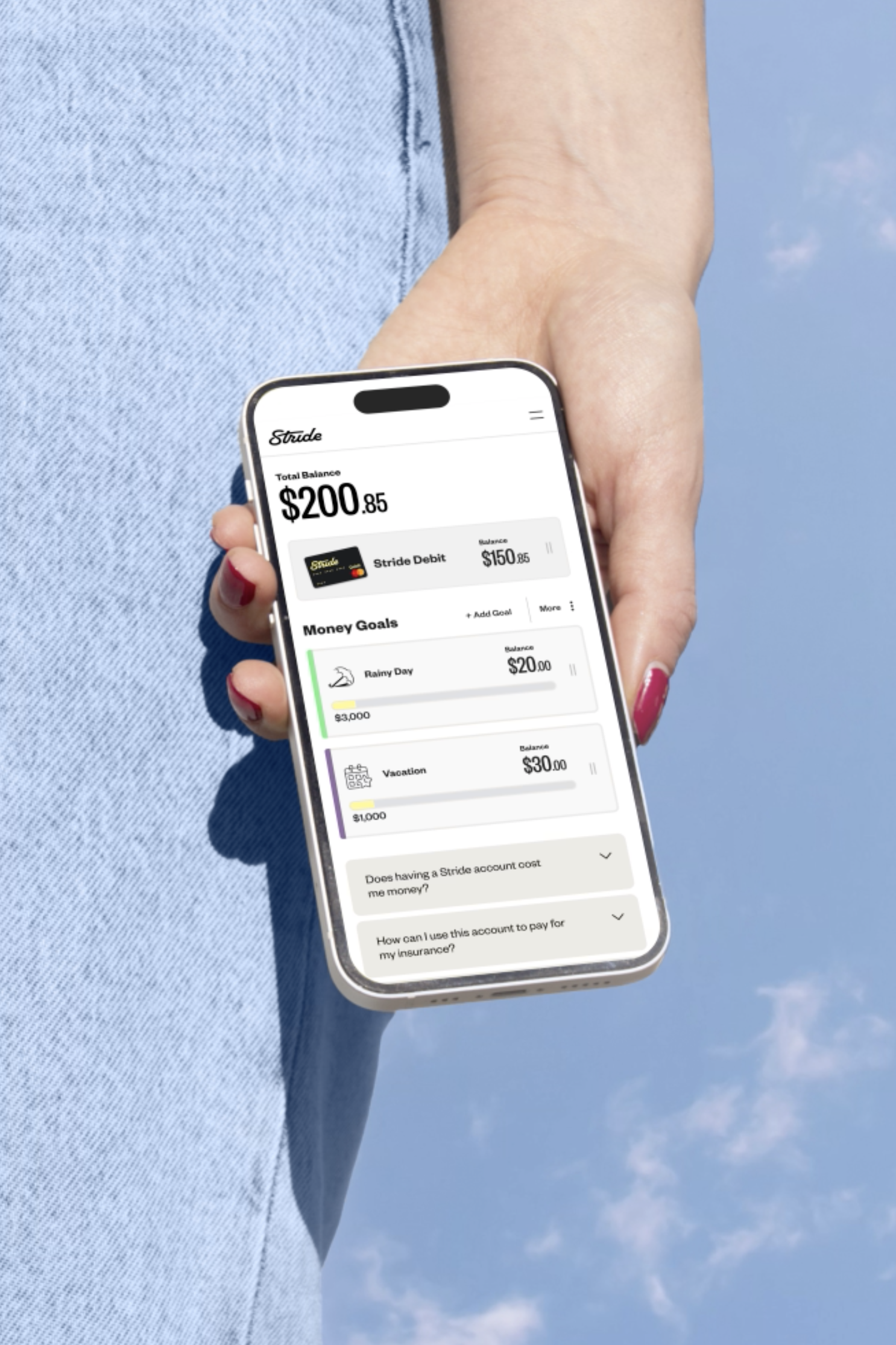

Introducing Stride Save* with Contributions: The Future of Worker Benefits

Today, we’re thrilled to announce that we’re expanding our portable benefits suite with a first-of-its-kind innovation, Stride Save, to help independent workers set aside money for savings and essential benefits.

How Medicaid Redetermination Impacts Gig Economy Workers

Now that the pandemic-era rules requiring continuous Medicaid coverage are ending, as many as 15 million Americans are at risk of losing access to health care coverage as states begin eligibility redeterminations.

One Company’s Trick to Getting 95,000 Hours Back? Canceling Meetings

With unnecessary work meetings abound, Stride has a solution. See why Stride was featured in the Wall Street Journal for our alternative to excessive meetings.

Our Portable Benefits Future is Here. Who Will Write the Rules of the Road?

Providing benefits like health insurance through employers no longer makes sense when nearly half of working Americans have multiple jobs — rather than a single, full-time job — and a growing number are doing part-time work, gig work, or freelancing.

Affordability Education Gap Is No. 1 Barrier to Increasing Independent & Gig Worker Health Coverage Rate, Per New Stride Health Survey

According to a new Stride survey, affordability is the biggest barrier in getting independent workers to enroll in health coverage. Here's what else to know.

The Future of Portable Benefits is Here... and It’s Not Just for Gig Workers

The old employer-based benefit model isn’t working: It provides little choice for workers, is too cumbersome for employers, and is too static for an economy that depends on dynamism. The fix? Individual Coverage Health Reimbursement Arrangements (ICHRAs) for all types of workers. Read what our CEO & Co-Founder Noah Lang has to say about this solution: