19 Top Tax Deductions for Writers

Wondering what you can deduct as a freelance writer? This tax deduction checklist just for writers will help you lower your taxable income as much as possible.

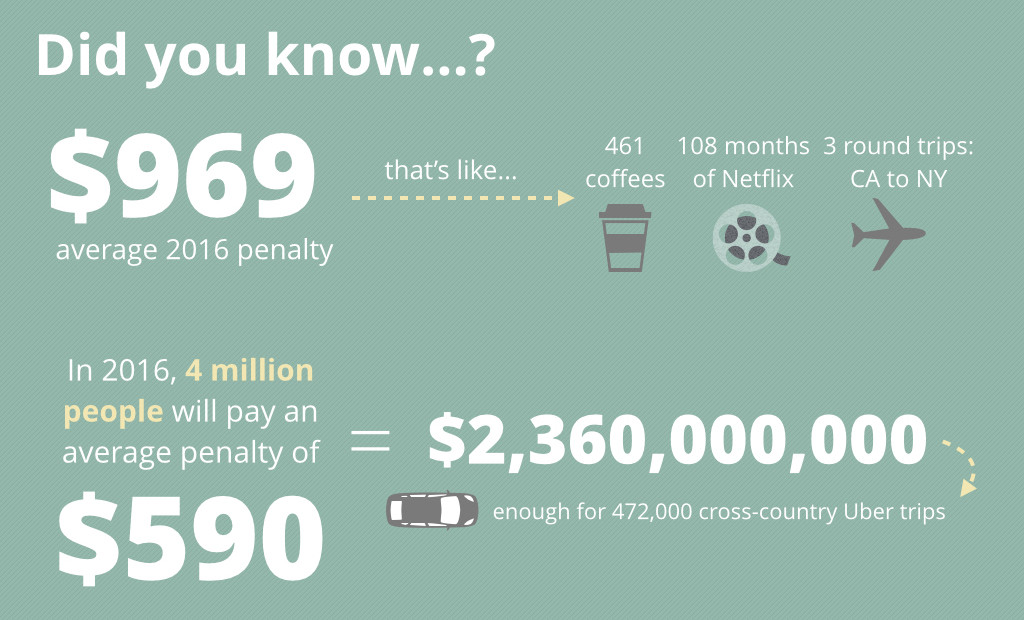

Understanding the Health Insurance Tax Penalty

Don't have health insurance? In certain states, you can be fined for this. Here's what to know about this tax penalty and why you should get coverage.

How to Import Past Mileage Into the Stride App

Tracking your rideshare mileage can help you save on taxes. Haven't been logging your miles? Here's how to import them into the Stride app after the fact.

What Rideshare Drivers Need To Know About Taxes

If you’re a rideshare driver, you probably have questions about how to track your expenses and what you can deduct from your income to lower your tax bill. Here are some of the most common questions we see.

What to Expect: HSA Forms and Taxes

Tax season is just around the corner. Here's everything you need to know about Health Savings Accounts (HSA) forms and how to use them to file your taxes.

COVID-19 Tax Credits (And How Self-Employed Workers Benefit)

Congress passed tax credits to provide relief to 1099 workers that were struggling during the pandemic. Here's everything to know about the tax credits.

The Ultimate Hair Stylist Tax Deduction Checklist

Wondering what you can deduct as a hair stylist? This hair stylist tax deduction checklist will help you lower your taxable income as much as possible.

Your Guide to Dog Walker and Sitter Tax Write-offs

Wondering what you can deduct as a dog walker or sitter? This tax deduction checklist could help you lower your taxable income so you save on your tax bill.