15 Makeup Artist Tax Deductions You Should Know

Wondering what you can deduct as a makeup artist? This makeup artist tax deduction checklist will help you lower your taxable income as much as possible.

Business Assets: What They Are and How to Deduct Them

Deductions can help you save on your tax bill. And business assets can be deductible. Here's what they are and how you can write them off when you file.

The Ultimate FAQ for New Tax Reform

New tax reform has switched up several things, including forms and deductions. But don’t worry — Stride has got you covered with this quick and simple FAQ.

What Is a 1040 Form and How Do I Complete It?

When you file an individual income tax return, you’ll use Form 1040 to report your income, deductions, and more. Here's what to know as you complete the form.

19 Top Tax Deductions for Writers

Wondering what you can deduct as a freelance writer? This tax deduction checklist just for writers will help you lower your taxable income as much as possible.

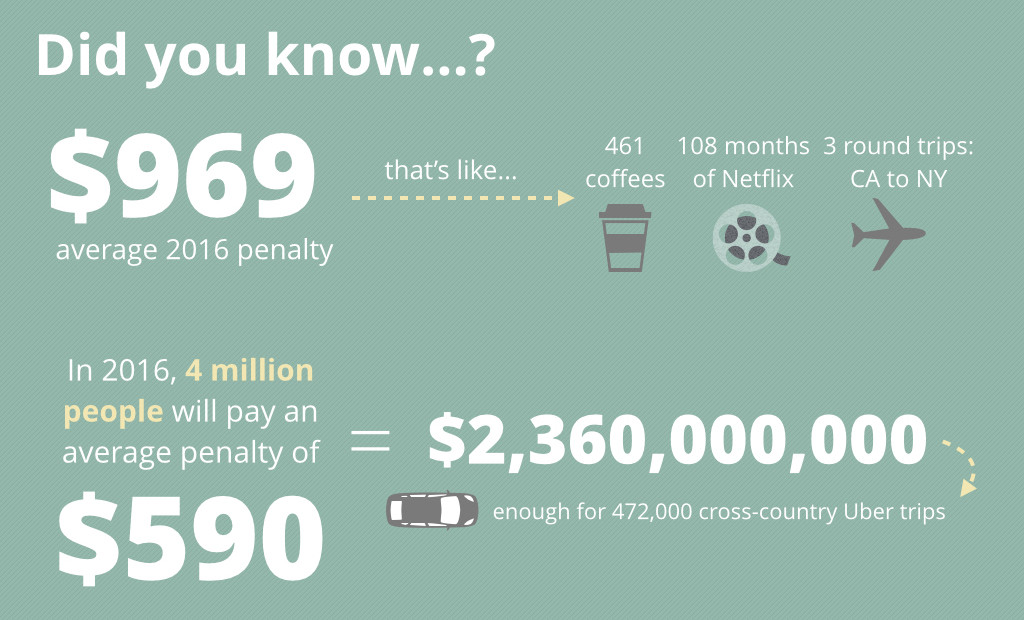

Understanding the Health Insurance Tax Penalty

Don't have health insurance? In certain states, you can be fined for this. Here's what to know about this tax penalty and why you should get coverage.

How to Import Past Mileage Into the Stride App

Tracking your rideshare mileage can help you save on taxes. Haven't been logging your miles? Here's how to import them into the Stride app after the fact.

What Rideshare Drivers Need To Know About Taxes

If you’re a rideshare driver, you probably have questions about how to track your expenses and what you can deduct from your income to lower your tax bill. Here are some of the most common questions we see.