I Missed Open Enrollment for Health Insurance, Now What?

Did you miss health insurance Open Enrollment? Learn your options and next steps in our guide.

Stride Launches Utah's First Independent Worker Portable Benefits Contributions Program

On the heels of last week’s exciting announcement, w’re launching the Stride Contributions program in Utah, following the state’s passage of new Portable Benefit Plan legislation (SB-233), which creates opportunities for companies to extend more benefits to 1099 workers.

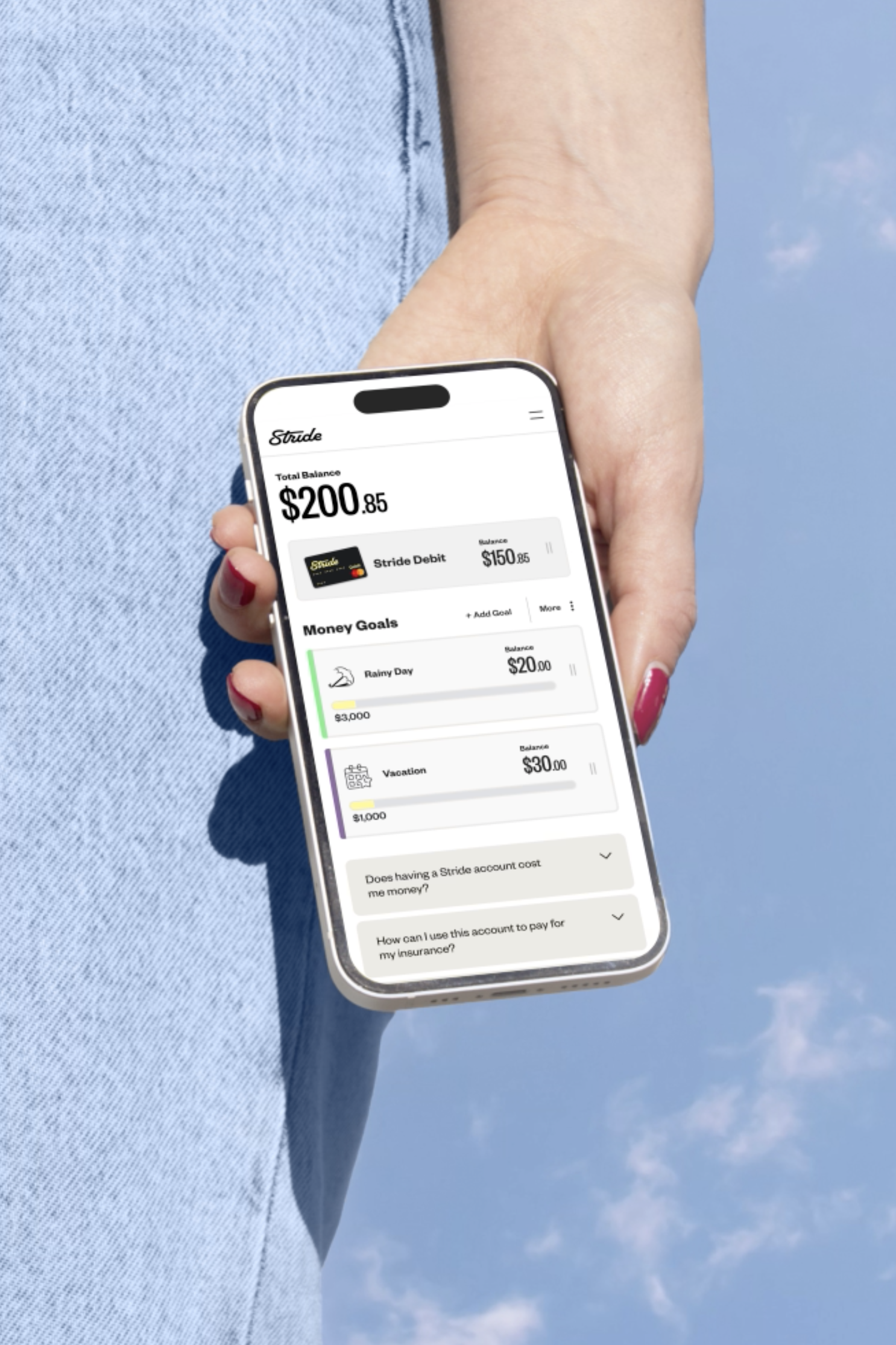

Introducing Stride Save* with Contributions: The Future of Worker Benefits

Today, we’re thrilled to announce that we’re expanding our portable benefits suite with a first-of-its-kind innovation, Stride Save, to help independent workers set aside money for savings and essential benefits.

What Is Supplemental Insurance?

What is supplemental insurance? Check out our comprehensive guide and learn about the types, benefits, and how to get extra coverage.

Taxes 101: Common Tax Terms You Need To Know

As an independent contractor, taxes can be complicated. Here's a guide to understanding tax terms, plus resources for 1099 workers to make taxes simple.

Vehicle Deduction: The Standard Mileage vs. Actual Expenses Method

Deducting car-related business expenses can help you save on taxes. Here's how to deduct using the standard mileage rate versus actual expenses method.

Why Keeping Track of Business Expenses Is So Important

If you're self-employed, tracking your business expenses throughout the year can help you lower your tax bill. Here's how to do it and why it saves you money.

Your Tax Filing Options and the Cost to File Taxes

When you have self-employment income, it can be tricky to decide how to file taxes. Here, we go over your options, the pros and cons, and the costs of each.