What Are Quarterly Taxes and How Do You Pay Them?

If you're an independent worker, you'll likely need to pay quarterly taxes. Here's what they are, how to pay them, and deadlines to know to avoid paying a fine.

What Is Form 1040 ES? Paying Your Estimated Taxes

To figure out if (and how much) you owe in quarterly taxes, you’ll need the Form 1040-ES. Here's what it is and how to use this form to file your taxes.

Tax Day 2025: Important 1099 Tax Deadlines

If you're an independent worker, you can expect to receive your 1099 form when tax deadlines are approaching. Don't worry, we've rounded up all the important dates you need to know about so you don’t miss any.

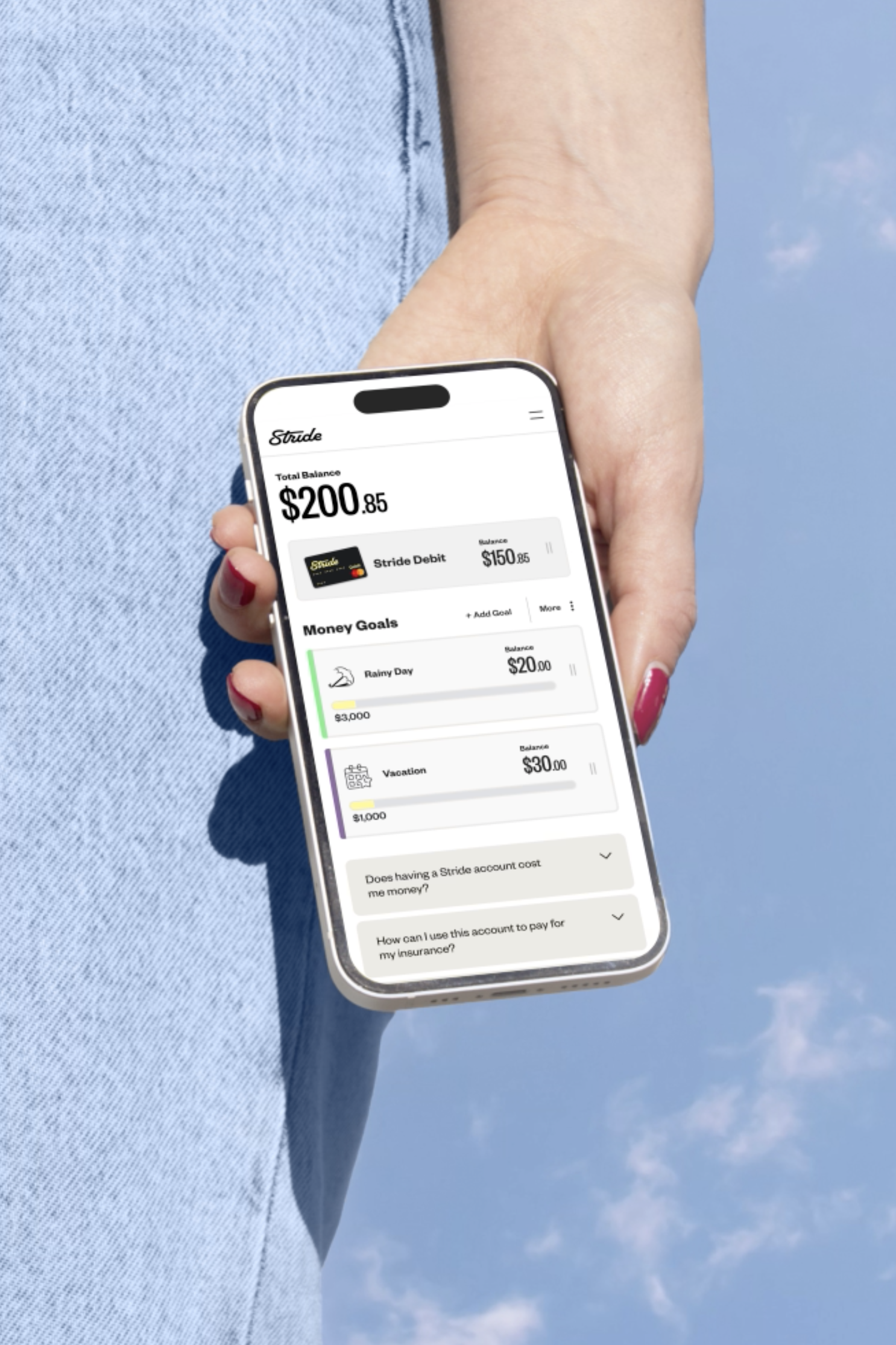

Stride and Roadie Partner to Empower Drivers with Financial Tools

We’re teaming up with Roadie, a UPS Company and a logistics management and crowdsourced delivery platform, to provide comprehensive support to independent drivers nationwide.

I Missed Open Enrollment for Health Insurance, Now What?

Did you miss health insurance Open Enrollment? Learn your options and next steps in our guide.

Stride Launches Utah's First Independent Worker Portable Benefits Contributions Program

On the heels of last week’s exciting announcement, w’re launching the Stride Contributions program in Utah, following the state’s passage of new Portable Benefit Plan legislation (SB-233), which creates opportunities for companies to extend more benefits to 1099 workers.

Introducing Stride Save* with Contributions: The Future of Worker Benefits

Today, we’re thrilled to announce that we’re expanding our portable benefits suite with a first-of-its-kind innovation, Stride Save, to help independent workers set aside money for savings and essential benefits.

What Is Supplemental Insurance?

What is supplemental insurance? Check out our comprehensive guide and learn about the types, benefits, and how to get extra coverage.