Portable Benefits Go Mainstream: A Year of Milestones

A little over a year ago, portable benefits were still mostly a concept. Today, they are a thriving, growing solution delivering real support to real people.

This past year has been a breakthrough moment — not just for Stride, but for the portable benefits movement as a whole. We’ve seen milestone after milestone: from the very first financial contributions delivered in July 2024, to multi-state expansions, new legislative wins, and a surge of interest from platforms, policymakers, and workers alike.

Across industries and states, thousands of independent workers are now receiving flexible financial contributions to help pay for health insurance, build emergency savings, and plan for retirement. Our groundbreaking partners — DoorDash, Shipt, and Lyft — have joined us in establishing benefits savings programs* that deliver valuable financial security to their workers through Stride's platform.

This isn’t just about gig work. Portable benefits are part of a broader shift. Millions of Americans are choosing independent work for the flexibility, autonomy, or supplemental income it provides. But until recently, those same workers were largely left out of the benefits system. Now, that’s starting to change. These contributions aren’t tied to a job or employer. They move with each individual, offering security in an increasingly flexible world of work.

It’s been a year of real momentum and proof that portable benefits are no longer a theoretical solution, but a tangible, scalable model for the future of work.

A Year in Portable Benefits:

- DoorDash launched in Pennsylvania in July 2024

- Shipt launched in Utah in July 2024

- Lyft launched in Utah in April 2025

- DoorDash launched in Georgia in April 2025

- DoorDash launched in Maryland in July 2025

- Uber and Lyft launched portable health stipends in Massachusetts in July 2025

A Year of Accelerating Progress

In July 2024, the first portable benefits pilot launched in Pennsylvania with DoorDash, fast-followed by a program with Shipt in Utah. The model was simple: allow work platforms to contribute funds to select workers' benefit savings accounts, which can be used for essentials like health insurance, emergency funds, or long-term planning.

Since then, the movement has expanded to multiple programs and states. And more are on the horizon.

Tangible Results for Workers

These initial programs have impacted thousands of workers and delivered millions in contributions to help them build financial security in ways that make sense for their lives and goals.

The early data is promising and shows that portable benefits are making a measurable difference. Here are a few results from the different programs running:

Workers are saving a majority of funds to be spent on future benefits (an average of $75 to $100 per distribution).

Emergency savings and retirement are the most common goals along with paying for health premiums and out-of-pocket medical expenses

89 percent of participants surveyed in one program said it has improved their financial security

It’s positively changing worker behavior too, building a more financially resilient workforce: 1-in-10 participants are making their own contributions to their benefits savings accounts, in addition to the dollars received from their work platform.

These benefits aren’t hypothetical. They are being used every day by real people who need them.

A Broader Coalition Leading the Way

The success of portable benefits has been made possible by a broad and growing coalition of partners.

Stride and platform companies like DoorDash, Lyft, Uber, and Shipt have not only launched portable benefits programs — they’ve also played a key role in advocating for the policies that make these programs possible.

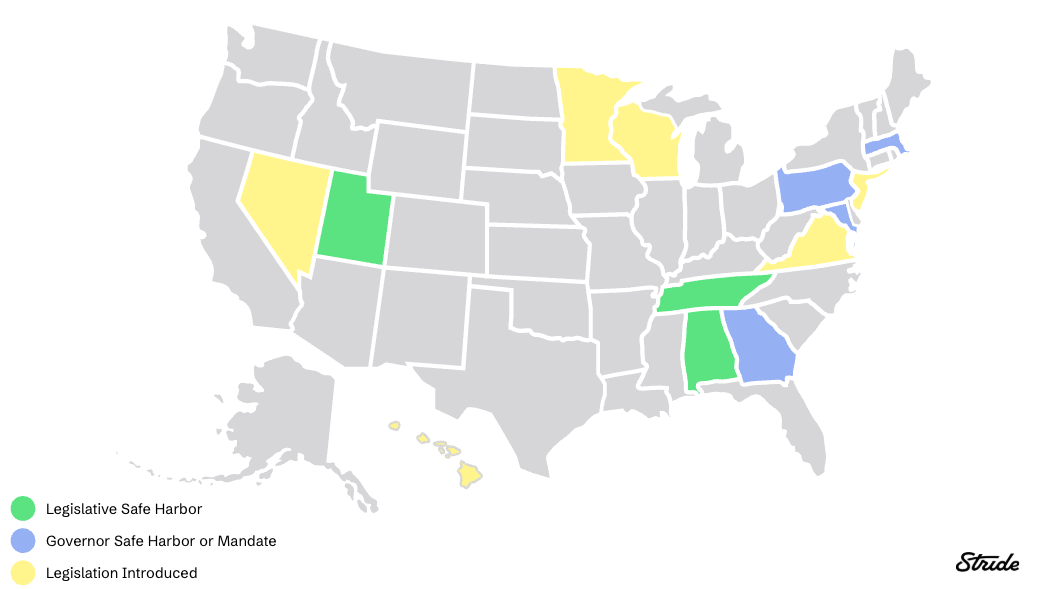

State leaders have also taken meaningful action. Governors in Pennsylvania, Maryland, and Georgia have worked closely with the private sector to create safe harbors for innovation, allowing companies to test new models while protecting workers.

Utah was the first to pass legislation, while Tennessee and Alabama followed with their own in April of this year to authorize or incentivize portable benefits. Wisconsin’s bill passed the legislature in June that is waiting for the Governor’s signature.

And at the federal level, the Unlocking Benefits for Independent Workers Act, introduced in the US Senate just last week, following the “Modern Worker Security Act” introduced in the House in February, to create a national safe harbor to allow more companies to contribute to worker benefits without employment status uncertainty. It would also create a clear pathway for more states to craft their own solutions, knowing their programs won’t be upended by federal ambiguity.

This kind of cross-sector, bipartisan collaboration is essential. It’s how we create a future of work that is both flexible and fair while moving toward a 21st-century benefits system.

Independent Work Is a Choice and It’s Growing

Today’s workforce looks nothing like the workforce of 50 years ago. More than 72 million Americans earned income through gig, freelance, or contract work last year, and surveys show that a large portion are doing so by choice.

American workers are choosing independence, flexibility, and control over how and when they work. But they also deserve access to tools that protect their financial futures.

Portable benefits offer a pathway forward. It’s a solution that recognizes that people may work with multiple companies, across industries, or on different schedules. Yet they still need the same basics: health coverage, retirement savings, and a disciplined way to make good financial decisions for their futures.

What Comes Next

The first year of portable benefits has proven that this model can work. Now the opportunity is to expand reach and access at scale.

We need more platforms and small businesses to offer contributions. We need state and federal governments to continue removing barriers. And we need the entire ecosystem — companies, nonprofits, legislators, and advocates — to keep pushing forward and continue changing lives.

We’re proud of the progress made and even more energized by what’s ahead. We’re grateful to our partners, supporters, and the policymakers who are helping make this future possible. Together, we’re building a more secure, more flexible benefits system that reflects how people actually work today.

*Stride Savings LLC is a financial technology company and is not a bank. Banking services are provided by i3 Bank, Member FDIC. The Stride Mastercard Debit Card is issued by i3 Bank pursuant to a license from Mastercard, Inc. and may be used anywhere Mastercard cards are accepted.