Pregnancy and Health Insurance Coverage, Explained

Before the Affordable Care Act (ACA), three in four individual health plans did not cover maternity care. Now, all ACA-compliant plans include maternity care as an essential health benefit, meaning they are legally mandated to help pay for certain pregnancy-related expenses. Have a bun in the oven? Here’s what you can expect from your health insurance.

Which maternity services are covered by insurance?

Health insurance plans are legally required to help you pay for:

Prenatal care: These are routine checkups and screenings throughout pregnancy to monitor your and baby’s vitals. This includes outpatient services like gestational diabetes screenings, lab studies, and certain medications.

Inpatient services: These are the costs associated with delivering your baby in a medical facility. This typically includes your OB-GYN’s services, one or two ultrasounds, the anesthesiologist (if you get an epidural), hospital room and board, lab fees, medical supplies, and more.

Postnatal care: These are the routine checkups, training, and supplies you’ll need after your baby is born. This includes lactation counseling and breast pump rentals.

If you opt to get your maternity care from a Certified Professional Midwife (CPM) instead of a traditional obstetrician, most insurance plans, including Medicaid, will help cover your costs. In fact, 32 states legally require health plans to offer coverage for CPM services. Home births are not as consistently covered by insurance and will depend on your specific plan choice.

How much will your pregnancy cost?

Expenses for an uncomplicated pregnancy cost $18,865 on average without health insurance! That’s why having coverage is so important. All ACA-compliant plans cap your annual medical spend to a few thousand dollars (also known as an out-of-pocket maximum), meaning you’ll pay a lot less than the uninsured average. The exact amount you’ll pay for your pregnancy depends on many factors, including your specific health plan, where you live, and at which facility you deliver your baby.

The best way to estimate your maternity expenses is to look at your Summary of Benefits. This is a document that explains how your insurance pays for different medical costs. You can find it by Googling “[Your Plan Name] Summary of Benefits.” Maternity care will be its own section. At the end of the document, the SBC includes a scenario that estimates how much a typical pregnancy will cost.

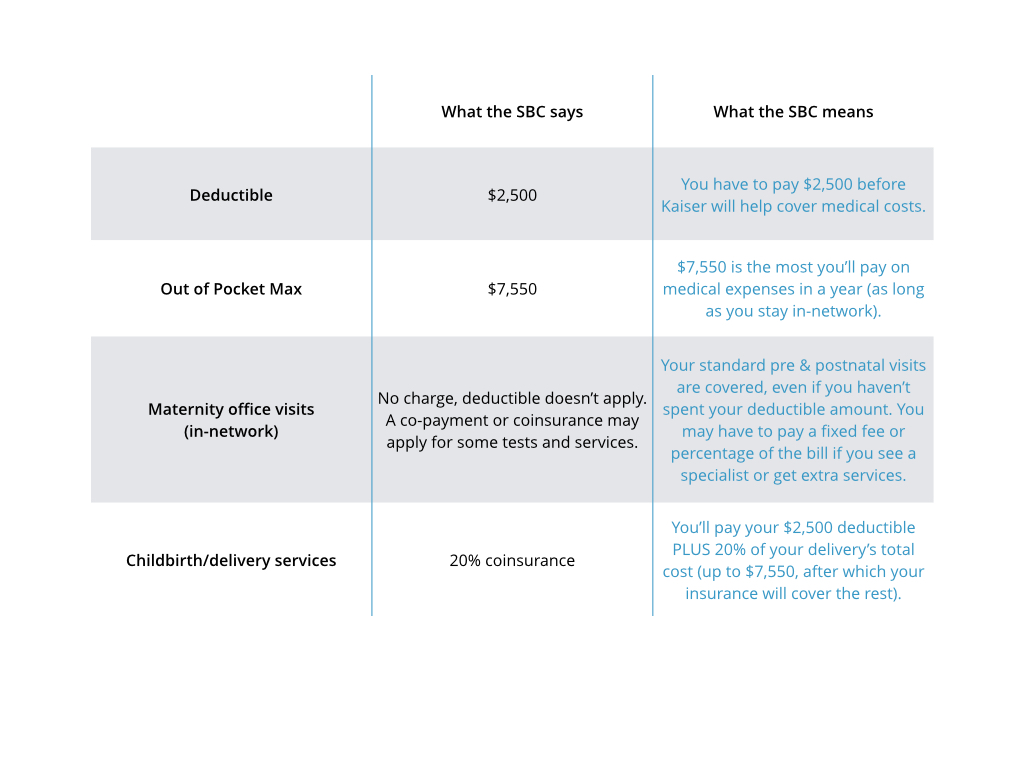

Wondering how to read your SBC? Let’s review an example. Here’s how to look at the SBC for a Kaiser silver HMO plan:

Changing your insurance after delivery

Having a baby counts as a qualifying event. This means that you have 60 days after your delivery to pick a new plan that covers your whole family or to add your baby to your existing plan. We recommend comparing your options to see if a new health plan will help you save money on your growing family.

If you anticipate getting pregnant in the coming year, you can also get coverage that will address these new health care needs during Open Enrollment, which runs from Nov. 1 to Jan. 15 in most states. Enter your ZIP code below to get personalized plan recommendations in less than five minutes.