What Is the Schedule C Form?

Filing taxes can be confusing. And when you’re an independent worker, there are additional forms you may need to fill out, including the Schedule C form. But don’t worry — we’re here to walk you through it.

The basics of Schedule C taxes

The Form 1040, which you use to file your federal tax return, has a whole host of related forms that must be filed depending on what kinds of income, deductions, credits, and other taxes you claim.

This means that Form 1040 serves as a kind of summary for all of those other forms. The other forms then serve to provide more information about the details of your tax return. If you’re self-employed, an independent contractor, or received any income as a 1099 worker in a given tax year, you’ll most likely need to file Schedule C: Profit or Loss From Business.

The Schedule C form is similar to Form 1040; it includes your income, your deductions, and details about yourself and your business. Each section of the Schedule C affects your tax liability, just like on the 1040.

The goal of the Schedule C taxes is to determine your business profit. The business profit comes from taking your business income and then subtracting your business expenses. This number is the income that is subject to taxation and is reported on Line 12 of your 1040.

How do I know if I need to file a Schedule C form?

If you use a tax filing software, this form will be automatically generated when you report that you are self-employed, or that you received a 1099-NEC or 1099-K.

Even if you don't receive a 1099-NEC, you may have to report your self-employment income.

Because companies aren’t required to issue 1099-NECs unless you were paid at least $600, you might have several sources of self-employment income that total well above $600 — without receiving a single 1099-NEC.

What kinds of expenses can I deduct on the Schedule C form?

The short answer: A lot. Depending on the type of independent work that you do, many of your “ordinary and necessary” business expenses are deductible, such as advertising, legal fees, and travel. This means that you can subtract your expenses from your total business income, and lower the amount of income that is subject to taxation.

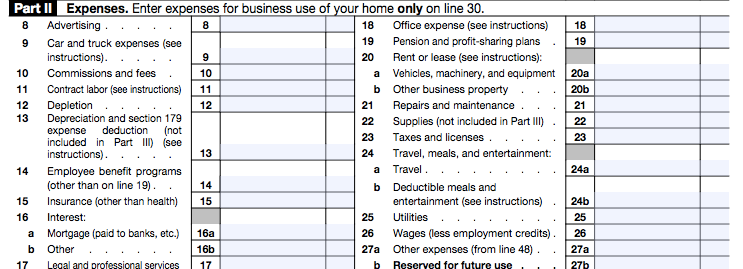

If you take a look at Part II of your Schedule C (or if you go through the Business Expenses interview pages of any tax filing software), you’ll see a lengthy list of deductible expenses. Any of those expenses that you paid in order to run your business may be deductible.

But here's the catch: When you deduct business expenses, it’s really important to document your expenses. If you’re ever audited, you’ll need to prove that the deductions you claim on your Schedule C were indeed for your business. That’s why it’s a good practice not to try to deduct expenses that you can’t substantiate with receipts, logs, or other records — especially if you deduct expenses that also serve some kind of personal use (like a cell phone). You can read a bit more about appropriate documentation here.

Heads up: You may need to fill out multiple Schedule C’s depending on how many different types of independent work you do. If you are both a rideshare driver and an independent graphic designer, you’ll need to fill out two separate Schedule Cs for each type of work, since they’re separate businesses. But if the type of work is the same — say you work for both Uber and Lyft — then you can combine both sources of income on one Schedule C as your only “ridesharing business.”

(Don’t forget to download the FREE Stride app, your one-stop platform to tackle all the challenges of independent work. It can help you save time and money on taxes by automatically tracking your miles and expenses, surfacing money-saving deductions, and getting your forms IRS-ready.)

If you’re wondering how to file Schedule C, the IRS Schedule C instructions provide guidance on what types of work warrant separate Schedule Cs. Pay special attention to the Business Activity Codes for guidance on what constitutes a unique “business activity” and thus a separate Schedule C. Don’t worry though — you’ll only need one Schedule SE to calculate your self-employment tax for all of your self-employment jobs.

Should I file a Schedule C-EZ form instead?

Maybe — there are a lot of requirements for filing a Schedule C-EZ (similar to to the Form 1040-EZ), so not everyone is eligible to file this quicker form.

The Schedule C-EZ is a shorter version of the Schedule C form. It’s shorter because it skips some of the less common sections or additional forms of the Schedule C that take a bit longer to fill out — for example, the depreciation or home office deduction forms.

You can file the Schedule C-EZ if you:

Had business expenses of $5,000 or less

Used the cash method of accounting (all rideshare drivers automatically use the cash method)

Did not have inventory at any time during the year

Did not have a loss from the business

Had only one business as either a sole proprietor, qualified joint venture, or statutory employee

Had no employees during the year

Do not have prior year unallowed passive activity losses from this business, AND

Will not deduct home office expenses or depreciation for business assets, like a cell phone or printer

If you’re filing your taxes with tax-filing software, the Schedule C-EZ will automatically be generated if you meet all of the necessary requirements. A tax preparer will do the same.

However, if you’re filing your taxes by hand, you may save yourself some time by using the shorter form. You’re not required to file the EZ if you’re eligible. So if you’re not sure whether or not you qualify, you might as well use the regular Schedule C just to be safe.

Disclaimer: The information contained in this guide is not offered as legal or tax advice. The U.S. federal income tax discussion included in this guide is for general information purposes only and is not a complete analysis or discussion of all potential tax consequences that may be relevant to a particular individual. In light of the foregoing, each individual should consult with and seek advice from such individual’s own tax advisor with respect to the tax consequences discussed herein. Any information contained in this guide is not intended to be used, and cannot be used, for purposes of avoiding penalties imposed under the U.S. Internal Revenue Code of 1986, as amended.