Plan Network Types Explained: HMOs, PPOs, EPOs, and POSs

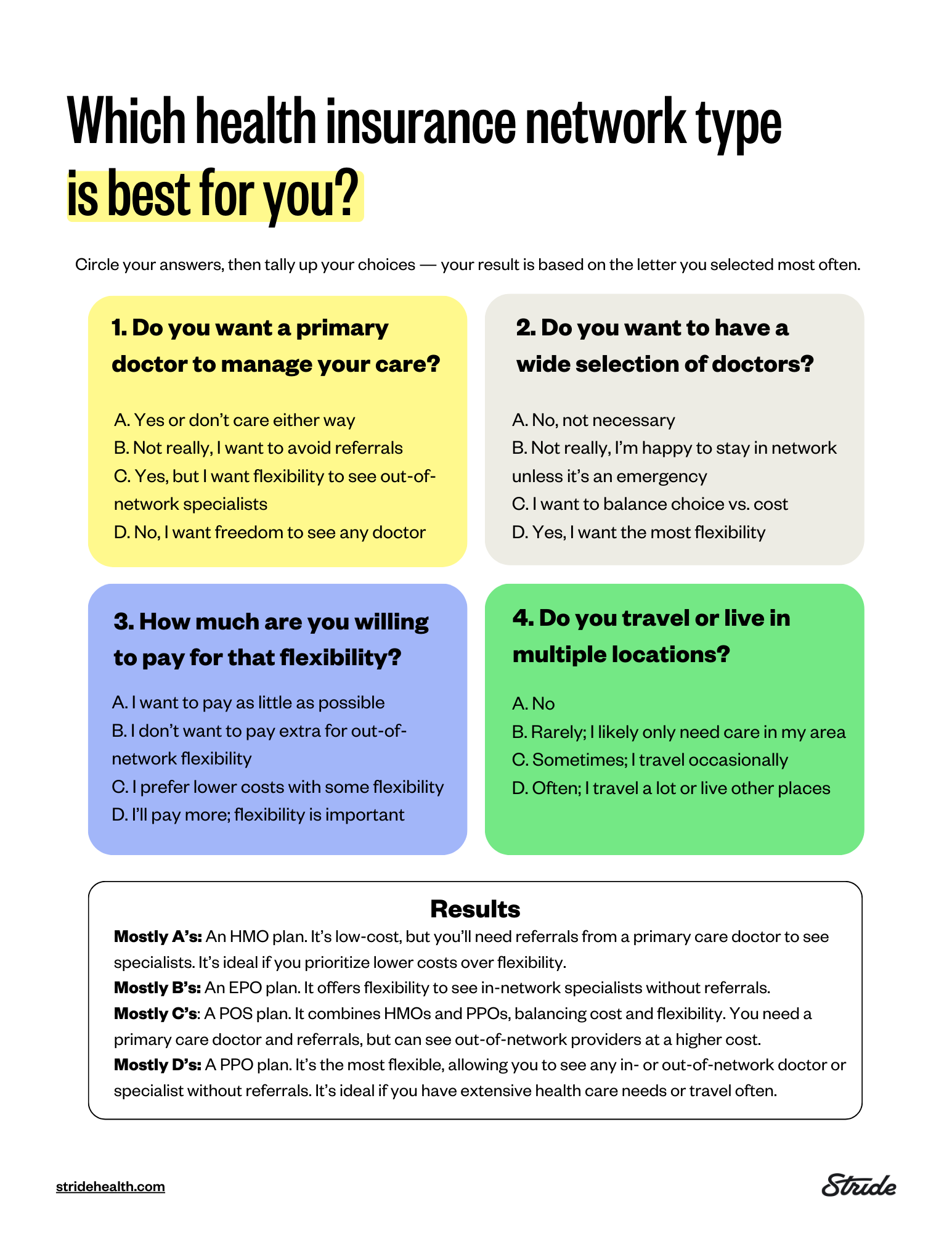

Health insurance is full of acronyms. Some of the most important ones, like HMO, PPO, EPO, and POS, make up the types of health plans you’re likely to come across. Which plan type you choose could affect where you can receive care, whether you need a referral to see a specialist, and how much you end up paying out of pocket. Here’s a breakdown of the four most common plan types, plus a quiz to help you decide which is the right fit for you.

HMO

A health maintenance organization plan — more commonly referred to as an HMO — requires you to select a primary care physician (PCP) who acts as a gatekeeper. Think of your PCP as your personal health quarterback, strategically coordinating all of your care and providing for your basic health care needs. If you ever need to see a specialist or require a diagnostic service (such as a blood test), you will need a referral from your PCP. Your referral will always be to a provider within your HMO network. If you choose to see a doctor outside of the network or without a referral, you will generally have to pay all costs out-of-pocket unless it is a true medical emergency or you have no other options. With an HMO, your physician network is local.

PPO

A preferred provider organization, also known as a PPO, is a health plan with a “preferred” network of providers in your area. You do not need to select a primary care physician and you do not need referrals to see a specialist. If you see a “preferred” (or “in-network”) provider, you will only be responsible for paying a portion of the bill, per your plan's coverage structure. If you choose to see a doctor who is outside the preferred network, you will generally have to pay a larger portion of the bill than you would for an in-network provider, but most plans will still cover a portion of the bill. With a PPO, you will have access to out-of-state providers that are considered in-network.

EPO

An exclusive provider network, or EPO, is a bit like a hybrid of an HMO and a PPO. EPOs generally offer a little more flexibility than an HMO and are generally a bit less pricey than a PPO. Like a PPO, you do not need a referral to get care from a specialist. But like an HMO, you are responsible for paying out-of-pocket if you seek care from a doctor outside your plan's network. An EPO is a good option if you want to see specialists without a PCP referral within your network.

POS

Finally, a point of service plan, or POS, is also a hybrid of an HMO and PPO plan. Like an HMO, you will need a referral from your PCP to see a specialist. But, like a PPO plan, you will pay less if you use doctors, hospitals, and other health care providers in the plan’s network, and you will have access to out-of-network providers at an increased cost.

Now that you know which type of plan is right for you, enter your ZIP code below to get personalized plan recommendations (and compare them!) in just five minutes.