What Is Self-Employment Tax and the Schedule SE Form?

Taxes can be confusing no matter your line of work. But if filing taxes as a 1099 worker has you overwhelmed, we don’t blame you — after all, you can’t rely on an employer to pay certain taxes on your behalf throughout the year. But don’t sweat it — we’re here to help you understand the ins and outs of self-employment taxes.

Why do I have to pay the self-employment tax?

When you’re self-employed, you’re required to pay taxes on your income that are the equivalent of what an employer typically pays on behalf of employees for taxes. Because you don’t have an employer paying these taxes for you, it’s your responsibility to calculate and pay them.

There are two parts of the self-employment tax:

Social Security: You’ll pay taxes of 12.4 percent on up to $168,600 of your business profit.

Medicare: You will pay taxes of 2.9 percent on your business profit.

To find out how much this actually amounts to, you’ll need to fill out a Schedule SE when you file your year-end taxes.

Typically, you’ll first fill out a Schedule C form for your independent business to calculate your total profit (earnings - expenses = profit). The Schedule C is where you list all the tax write-offs (like mileage and cell phone deductions) you’re entitled to as an independent worker.

(Don’t forget to download the FREE Stride app, your one-stop platform to tackle all the challenges of independent work. It can help you save time and money on taxes by automatically tracking your miles and expenses, surfacing money-saving deductions, and getting your forms IRS-ready.)

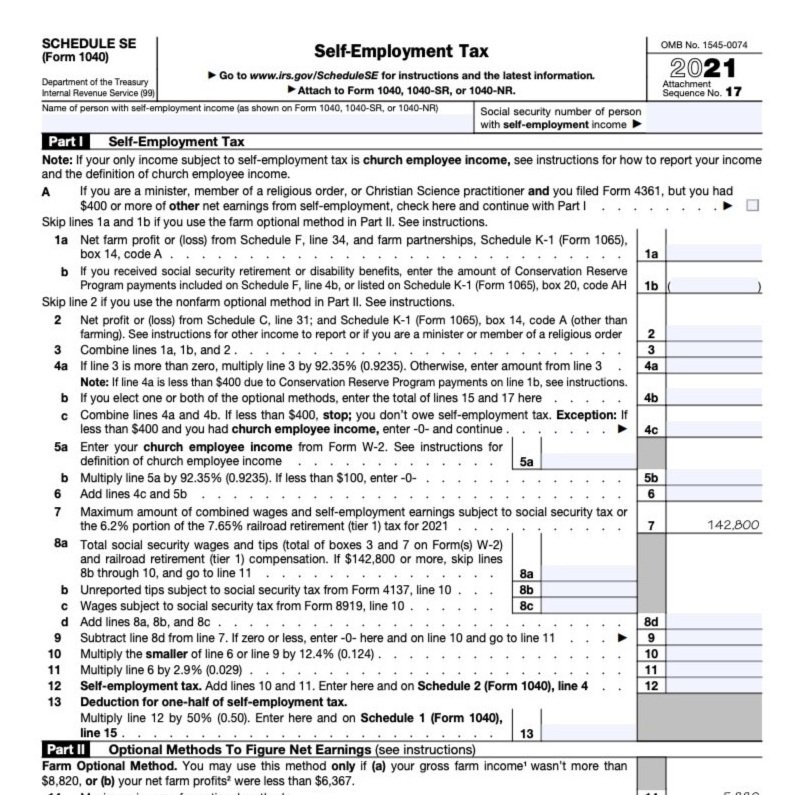

Filling out the Schedule SE form

Next, you’ll need to fill out the Schedule SE form. Note: There is no longer a Short Schedule SE available as a filing option.

Here’s a line-by-line breakdown of the Schedule SE, Part 1.

Line 1a: Net farm profit. This applies to farmers; it’s where they note their total profit or loss.

Line 1b: Social Security, Retirement, or Disability. Enter the amount you’ve received from any of these programs here.

Line 2: Net profit (or loss) from the Schedule C . Here is where you’ll write in the profit or loss from your Schedule C.

Line 3: Add it all together. Insert the sum the numbers you wrote above here.

Line 4: Calculate your tax obligation. This is where you multiply the line above (3) by 92.35 percent (0.9235). If this amount is less than $400, then you do not need to pay any self-employment tax. Write the total amount after multiplying on this line.

Lines 5a-8d are less common instances that most people won’t have to fill out.

Lines 10 and 11: Calculate your Social Security and Medicare tax obligations

Line 12: Add lines 10 and 11 together to get your self-employment tax.

Line 13: Deduction for one-half of self-employment tax. Multiply line 12 by 50 percent (0.50). Enter the result here and on Form 1040, Line 14.

This line means you get to deduct one-half of the amount you’ll pay for self-employment tax. This is deducted from your total taxable income that’s subject to the income tax (calculated on the 1040). This is where the IRS makes sure you pay a lower amount on overall income tax because of the self-employment tax you pay (as mandated by Self-Employment Contributions Act).

Remember to plug the final amount from Line 12 into your 1040. Once you’ve done that, you are done with calculating your self-employment tax.

Disclaimer: The information contained in this guide is not offered as legal or tax advice. The U.S. federal income tax discussion included in this guide is for general information purposes only and is not a complete analysis or discussion of all potential tax consequences that may be relevant to a particular individual. In light of the foregoing, each individual should consult with and seek advice from such individual’s own tax advisor with respect to the tax consequences discussed herein. Any information contained in this guide is not intended to be used, and cannot be used, for purposes of avoiding penalties imposed under the U.S. Internal Revenue Code of 1986, as amended.