Stride Tax Report - Identity, tenure and taxes in the evolving Rideshare Industry

Summary

In conjunction with the release of Stride Tax, a new app for rideshare drivers to increase their take-home-pay, Stride sought to gain better insight into several key questions regarding drivers: How do they identify themselves? How much do they work? What does their full employment situation look like? And how much could tax deductions increase their income? The company surveyed more than 1,000 drivers and analyzed over $15 million in tracked tax deductions to better understand drivers’ effective tax rate.

Key Findings

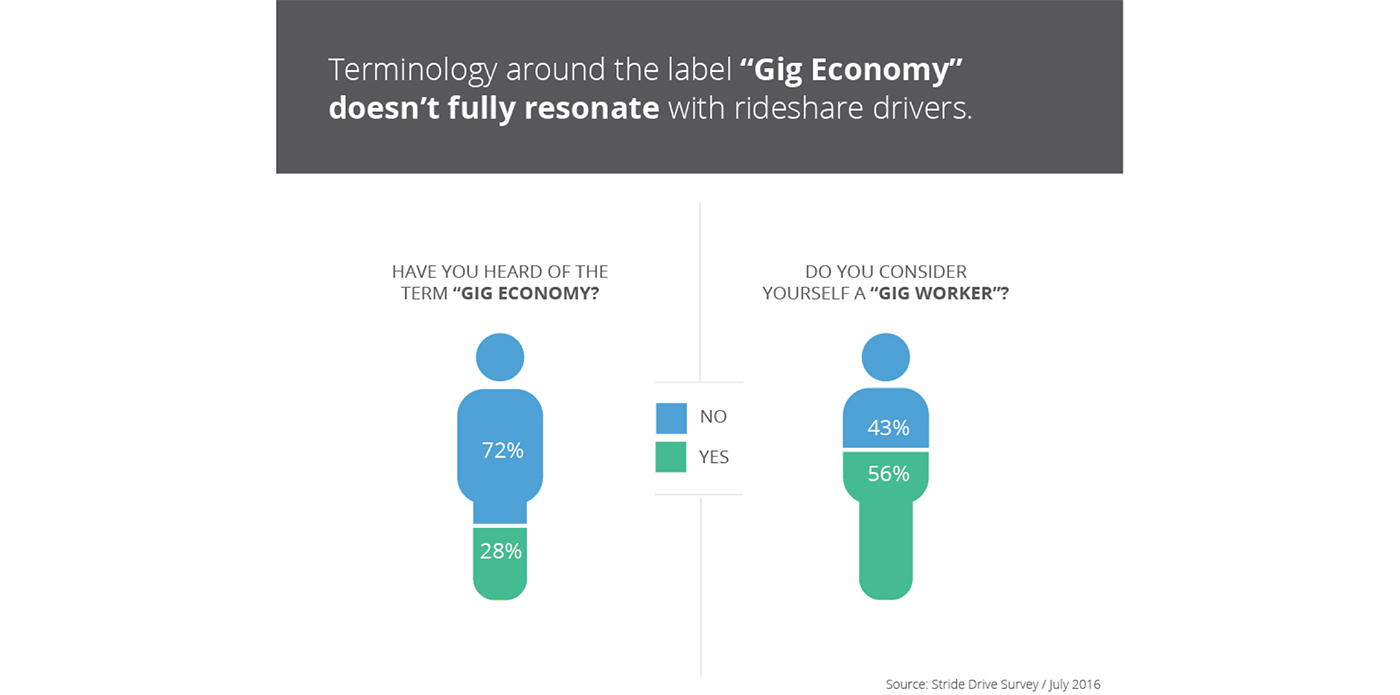

Identity: 72% of rideshare drivers have never heard of the gig economy (though 56% willingly identify as gig workers when it is suggested). Overarching labels don’t fully describe drivers, half of whom also work traditional W-2 jobs.

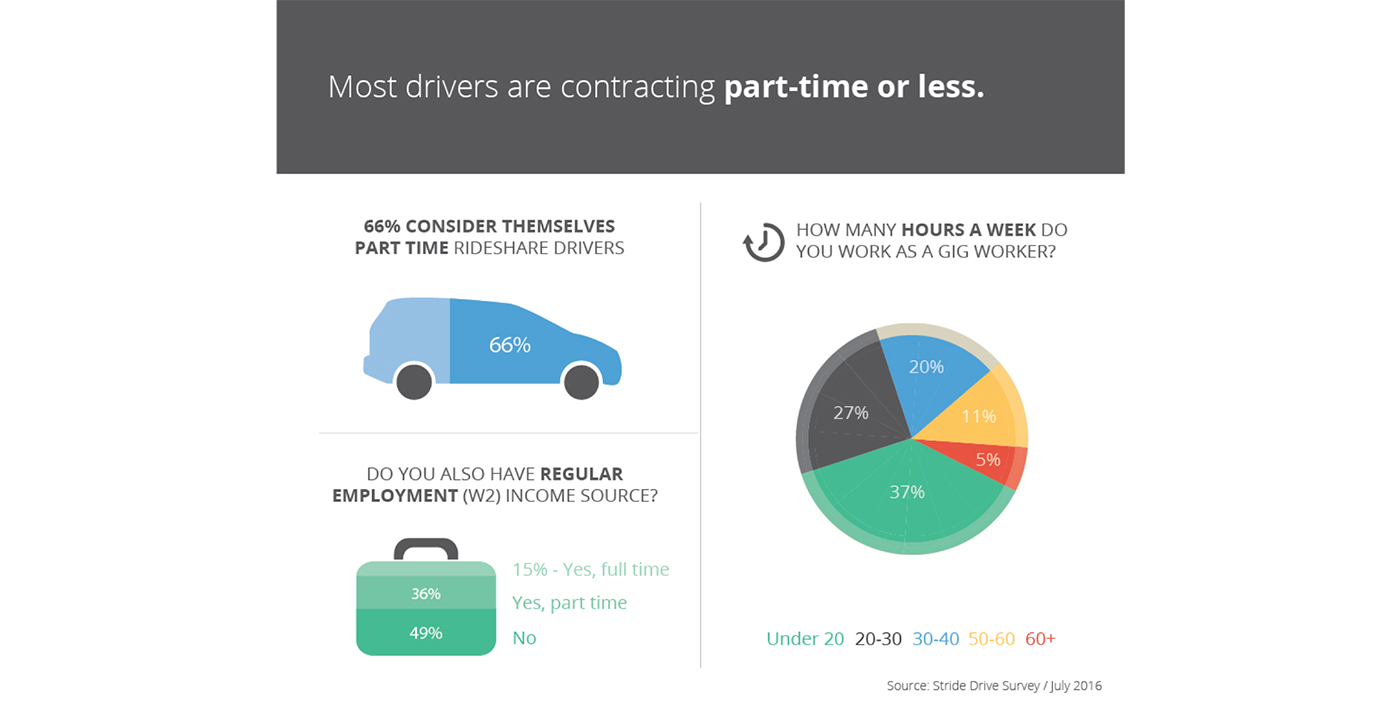

Employment Snapshot: 51% of all drivers also have either full-time or part-time jobs and most drive less than 30 hours a week.

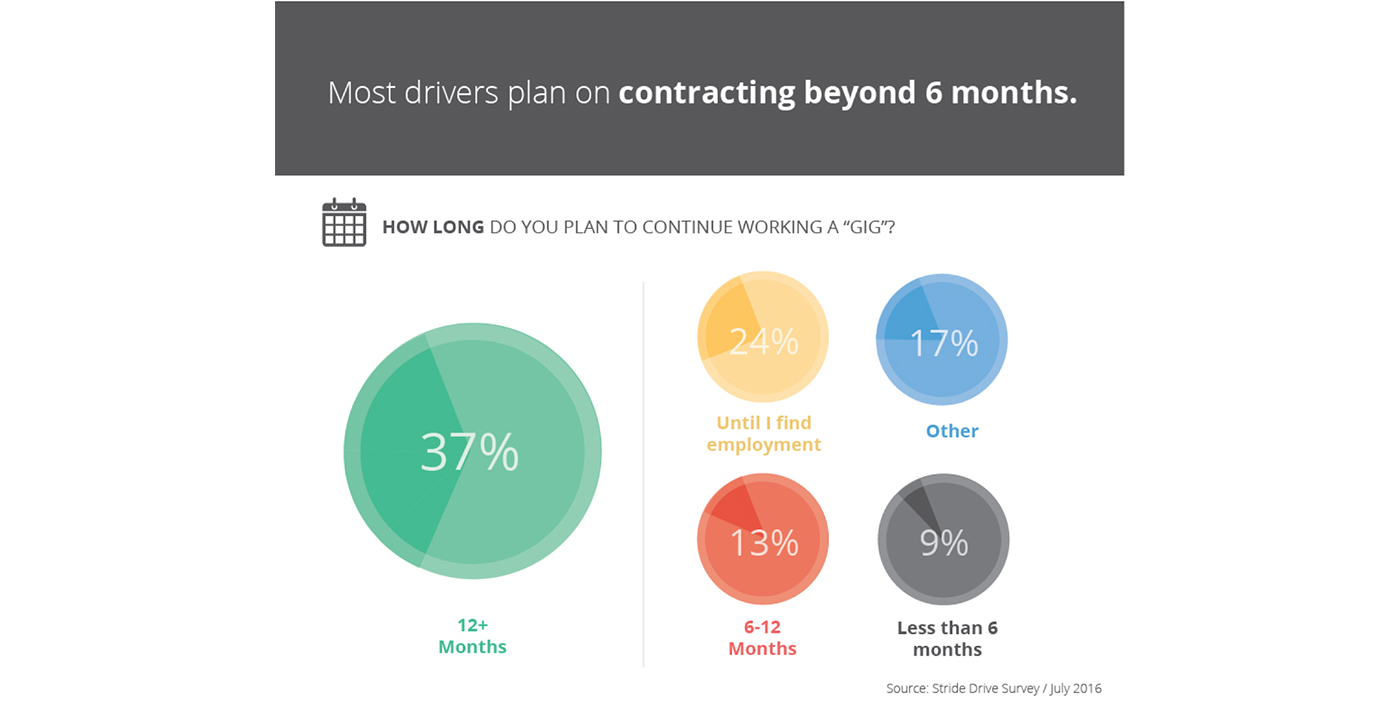

Tenure: 37% of drivers plan on driving beyond a year.

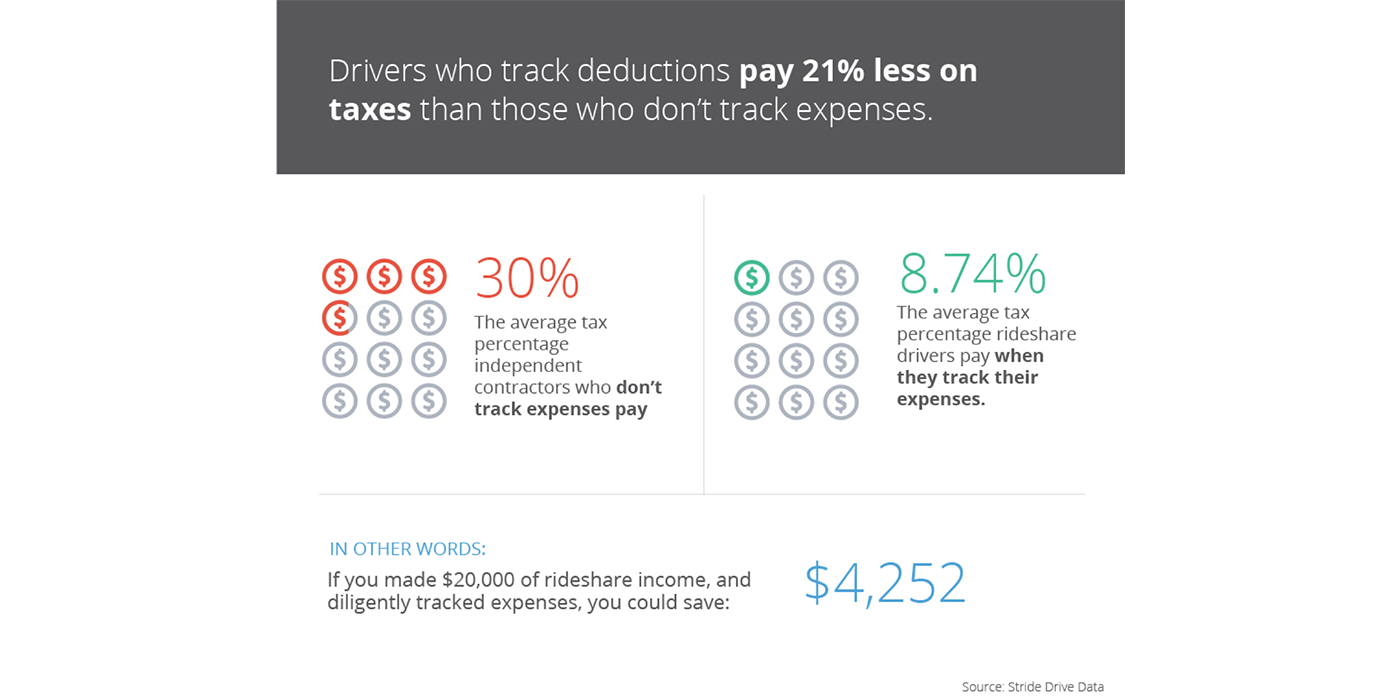

Taxes: As a rule of thumb, the average independent contractor should set aside 30% of each paycheck to account for taxes.* According to Stride Tax data, drivers who track deductions lower their effective tax rate to 8.7% on average.

As a diverse group, rideshare drivers don’t identify with the gig economy.

A recent Pew survey found that only 1 in 10 Americans have heard of the gig economy. Stride wanted to understand how rideshare drivers would respond to the same question. When asked about their familiarity with one of the leading terms, “gig economy”, an overwhelming majority (72%) had not heard of it.

When presented with the option to be identified as a gig worker, 56% of drivers responded “yes.” As subsequent takeaways reveal, many drivers have both 1099 and W-2 income, which complicates questions around what kind of work a driver identifies with. For example, if a driver only works for Uber 10 hours a week and spends another 40 hours in a full-time W-2 job, they could see themselves foremost or solely as a traditional worker, rather than a gig worker.

Most drivers are contracting part-time or less.

As the industry grows, many drivers begin ridesharing to supplement existing and often traditional income sources. When asked if they also have regular W-2 employment, 50.7% responded with having either part-time or full-time income in addition to ridesharing.

The vast majority of drivers, 66%, work on rideshare platforms part-time. And most drivers are using their rideshare income to complement other sources, both W-2 and 1099.

The largest segment of drivers (37%) spends less than 20 hours per week contracting. From this group, 27% work on non-rideshare platforms. The second largest segment of drivers spends 20-30 hours per week contracting. An even smaller segment, 20%, spends 30-40 hours contracting, which approaches a full-time job in terms of hours. Only 16% work over 40 hours a week.

Driver appetite for contracting remains strong.

Half of drivers (50%) plan to continue contracting for six months to a year. On the other end of the spectrum, few contractors today plan on stopping within six months – only 9%. Another 24% only plan on driving until they find traditional, W-2 employment.

Drivers who track deductions for their ridesharing business lower their effective tax rate to 8.7%, which is almost 21% less than a contractor not accounting for deductions.

As a rule of thumb, accountants encourage independent contractors to set aside 30% percent of each paycheck to cover taxes*. Yet, if contractors are diligently tracking deductible expenses, they can significantly lower that rate. Data from the Stride Tax app reveals that most rideshare drivers are paying much less in taxes than others who don’t track expenses: on average, drivers pay an effective tax rate of 8.7%. In other words, for a driver who earns $20,000 and diligently tracks expenses, they can expect to owe $1,748 in 1099 taxes versus $6,000 without expense tracking. That’s a difference of $4,252 in taxes saved for drivers maximizing deductions.

Conclusion

As the ridesharing industry matures, drivers are approaching their work with a part- time mindframe, yet a desire for longer term job engagement. Most drivers use their rideshare earnings to supplement existing income sources or as a carry-over between jobs. Half of drivers plan to continue driving beyond the next 6 months. As more drivers become aware of how to track and maximize deductions, they are increasing the viability of rideshare as an income source – effectively keeping more of what they earn.

Methodology

Data included in this report is sourced from an online survey of 1,115 Stride Health members (18 and older) who drive for Uber and also use Stride Tax to manage expenses and tax deductions. The survey was conducted July 22, 2016. Additional statistics on effective tax rate come from income and deductions logged among drivers using the Stride Tax app with a sample of 1,190 drivers.

*Analysis assumes a 30% tax rate for self-employed rideshare drivers. This is comprised of 15.3% self-employment tax and a rolled up total of 14.7% federal, state and city taxes. A number of demographic assumptions about typical rideshare drivers have been made, most notably: their filing status is single, they take their exemption and standard deduction, $40,000 in revenue from all income sources, and incur average maintenance costs for their vehicle.

About Stride

Stride Health is the leading benefits provider for independent workers. The company supports independents’ physical and financial well being with tools for maximizing income and ensuring the sustainability of their businesses-of-one. Stride’s health insurance recommendation engine connects independent workers to the best health insurance plans in all 50 states. Stride members’ insurance coverage is managed by an award-winning advisory team and software that provides access to in-network medical practitioners and negotiated drug prices at 70,000 local pharmacies.

Stride Tax expands the suite of benefits available to independent workers with automated tax tracking and access to essential income protection.

Based in San Francisco and available nationwide, Stride Health (www.stridehealth.com) launched in early 2014 and is venture-backed by the leading health and consumer finance firms Venrock, New Enterprise Associates, and Fidelity’s F-Prime Capital.