How To File Taxes Using Your Uber 1099-NEC and 1099-K

As an Uber driver and independent contractor, you’ll get a 1099-K or 1099-NEC form instead of a W-2 when it comes to taxes. Uber typically sends these out before or around January 31.

Deciphering the K and NEC versions of these 1099 forms can be tricky, mostly because they contain a lot of information that isn’t particularly useful to you when you’re filing your taxes. In reality, there are only a few numbers that you need to be aware of when you’re using your 1099s to file your taxes.

Here’s what to know so you know how to file 1099 forms for Uber correctly.

(Don't forget, the FREE Stride App can help you save thousands of dollars on your tax bill and hours of tax prep time by automatically tracking your miles and expenses, surfacing money-saving deductions, and getting your forms IRS-ready. Get it today!)

Step 1: How to Read Your Uber 1099-K and 1099-NEC

Uber reports earnings on two different forms: the 1099-NEC and the 1099-K. Here’s how to find your earnings on both forms:

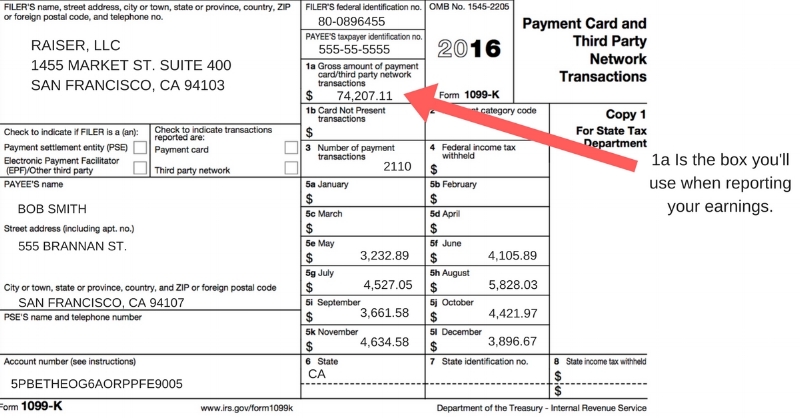

Your Uber 1099-K

You should definitely receive a 1099-K from Uber, because this is what reports your earnings in fares. What you’re looking for here is Box 1a: Gross amount of payment card/third party network transactions.

Uber will send you a different 1099-K for each state in which you've completed trips. So if you've completed trips in both New York and New Jersey, you'll get a 1099-K for each set of fares.

Funny name for earnings right? That’s because Uber is technically a third party network, meaning they facilitate your rideshare business by finding you passengers and transferring payment between the passengers and you. So instead of reporting that you did work for Uber, they report your pay as money earned via Uber.

Is Your Uber 1099-K Reporting a Number Higher Than What You Actually Earned?

Don’t worry — this is normal, and the IRS instructions for this form actually require Uber to report the gross amount of payments that they facilitated. That gross number includes what you earned and Uber’s fees.

You will not, I repeat, will not, have to pay taxes on Uber’s fees. You will report the gross amount on the Schedule C, but deduct Uber’s fees as a business expense. No sweat, you will only pay taxes on what you actually earned, and we’ll show you how below.

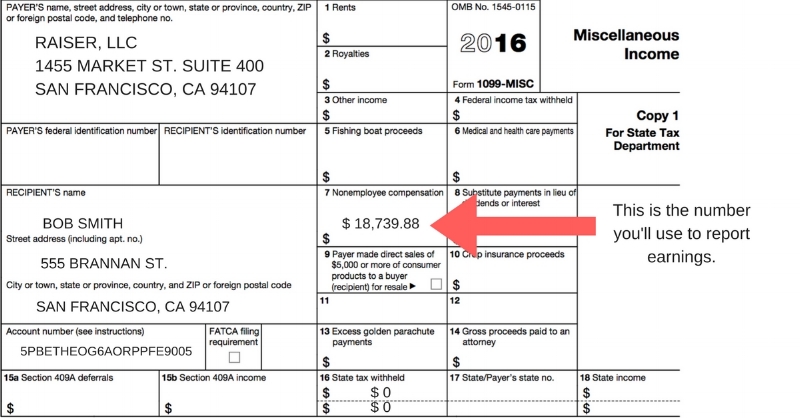

Your Uber 1099-NEC

If you receive a 1099-NEC from Uber, it’s because you’ve earned at least $600 from incentives or referrals. This is a gross number like you see on the 1099-K, but it doesn’t include any Uber fees or commissions and should match exactly with what you received in payment from Uber for any promotions, incentives, or referrals. There are a lot of different sections of the form, but what you’re looking for is Box 7: Nonemployee compensation.

Compare this number with your Uber Tax Summary for 1099-NEC earnings. They should match up.

However, if you didn’t receive a 1099-NEC, you may still have income to report. Uber only sends a 1099-NEC reporting incentive and referral income if you made at least $600, so even if you didn’t receive one, you should check your Uber Tax Summary to see if you received any of this type of income. You’ll see under the “1099-NEC Breakdown” whether you have income to report in addition to the income on your 1099-K.

Step 2: How to Report Earnings

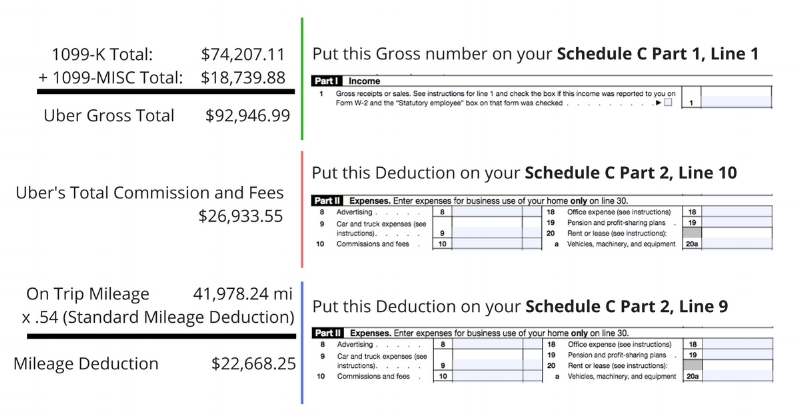

Even though you didn’t receive the total amount reported on your 1099-K in your bank account, you still report that total (don’t worry, you won’t pay taxes on Uber’s fees). You’ll add that 1099-K gross number plus your 1099-NEC number to get total earnings (“Gross receipts or sales”). Your next move depends on whether you’re using an accountant, tax filing software, or filling out your own Schedule C:

If you’re working with an accountant or tax preparer: Your accountant will know what to do with your 1099s. Make sure they also have your Uber Tax Summary and any business expenses you plan to write off (like mileage, passenger goodies, etc).

If you’re filing using tax software: No adding is necessary for inputting the 1099-NEC and 1099-K. Your tax software will ask you to fill out information from the forms and calculate the sum for you. If you didn’t receive a 1099-NEC but have referral and incentive income to report, you can include it as “Other income” for your business.

If you’re filling out a Schedule C: Add the 1099-K and 1099-NEC earnings amounts together. Then, report your total income (from your 1099-NEC and your 1099-K) all on Line 1 of your Schedule C. If you didn’t receive a 1099-NEC but have referral and incentive income to report, you can include it as “Other income” for your business.

Step 3: How to Deduct Uber’s Fees

This is where things get interesting. As mentioned above, your Uber 1099-K reports income that includes Uber’s fees. That means you’ll need to deduct these fees as a business expense so you don’t pay taxes on them.

Add Up Uber’s Fees

First, you’ll need to sum Uber’s fees. These include fees like the booking fee, which is a separate flat fee added to every trip that helps support safety initiatives for riders and drivers.

To add up Uber's fees to determine how much you should claim as an expense, first subtract what you actually earned (excluding referrals and promotions reported on the 1099-NEC) from gross earnings reported on the 1099-K and 1099-NEC.

Here's another way to calculate this using your Uber tax summary, as outlined below:

Here's how you use the numbers above to do your own calculations and where each total belongs in a Schedule C:

Uber’s fees are deductible as “Commissions and fees” on your Schedule C.

If you’re working with an accountant: Make sure they have this number to deduct for you.

If you’re using tax filing software: You’ll be prompted for business expenses to deduct. Make sure to include this one and they’ll automatically plug it into a Schedule C.

If you’re doing your own taxes: You’ll deduct these on Part II, Line 10 on your Schedule C.

Any charge taken out of the total that’s reported on your 1099s can be deducted as a cost of doing business. Just be sure to keep your tax summary as documentation in case of audit.

One note: Be sure not to double-deduct anything. For example, if you rent a cell phone from Uber and have already recorded the expense elsewhere, subtract that expense from the total “Commissions and fees” that you deduct.

Tade Anzalone heads up Stride’s tax and finance support and is a registered tax return preparer and 2017 Annual Filing Season Program Participant. In addition to her years of experience helping people navigate complicated finance and tax obligations, she has degrees in Government, Psychology, and Spanish from Georgetown University.

Disclaimer: The information contained in this Guide is not offered as legal or tax advice. The U.S. federal income tax discussion included in this Guide is for general information purposes only and is not a complete analysis or discussion of all potential tax consequences that may be relevant to a particular individual. In light of the foregoing, each individual should consult with and seek advice from such individual’s own tax advisor with respect to the tax consequences discussed herein. Any information contained in this Guide is not intended to be used, and cannot be used, for purposes of avoiding penalties imposed under the U.S. Internal Revenue Code of 1986, as amended.