What Is a 1099-NEC?

If you’re an independent contractor, you’ve likely heard of the 1099-NEC form, but you might not know how it affects your taxes. Stride is here to explain everything you need to know about the 1099-NEC form so you are ready to tackle tax season.

What is a 1099-NEC form?

There are 15 different types of 1099 forms, and the 1099-NEC is just one of them! The 1099-NEC is a form that reports how much you’ve been paid by a company. 1099-NECs are only sent to non-employee individuals. Put simply, the 1099-NEC is used by companies to report how much they’ve paid independent contractors. For example, if you deliver for Postmates, you’re considered a contractor instead of an employee; Postmates reports their payments to you for the year with a 1099-NEC instead of a W-2.

Who will receive a 1099-NEC?

If you work as an independent contractor, you are eligible to receive a 1099-NEC. However, a company is only required to provide you with a 1099-NEC if you’ve received at least $600 in payments in a given tax year. While the company you work for might issue you a 1099-NEC if you don’t meet this $600 threshold, it is not required to.

What companies provide a 1099-NEC?

Some of the most popular gig economy companies provide 1099-NECs. Some of these companies include:

Postmates

Instacart

Rover

And many more!

Keep in mind, companies are only required to issue a 1099-NEC if you meet the requirements mentioned above.

When will I receive my 1099-NEC form?

Just like other 1099 forms, your 1099-NEC needs to be postmarked by January 31 at the very latest. This means you should have it in your hands by early February!

What is the difference between a 1099-NEC and 1099-K?

While the 1099-NEC and 1099-K both report business income you received during the tax year, they are two different forms. Here are the main differences:

Form 1099-NEC reports payments to independent contractors of all kinds, while a 1099-K is limited to only reporting payments to you by a third party. Some gig apps send out a 1099-NEC and others use a 1099-K. Whichever one you receive is fine, but you’ll use them differently when you file your taxes.

On a 1099-K, you will see the gross amount of transactions processed on your behalf. This means that the number you see includes fees and commissions, which you can claim as business expenses on your taxes. Your 1099-NEC will not include these, so you can report this income as-is on your tax return.

The threshold for receiving a 1099-K is much higher than that of a 1099-NEC. In order to receive a 1099-K, the company that processes payment for you must facilitate 200 or more transactions for you and these transactions must total $20,000 or more.

If this seems confusing, don’t stress! It isn’t your responsibility to determine which form you receive, so whichever form a company sends you, you should be fine using that to file your tax return. A good rule of thumb you can follow to differentiate these two forms it that, in general, freelancers and contractors will receive a 1099-NEC and freelancers working in the on-demand economy will receive a 1099-K.

How do I use my 1099-NEC when I file my taxes?

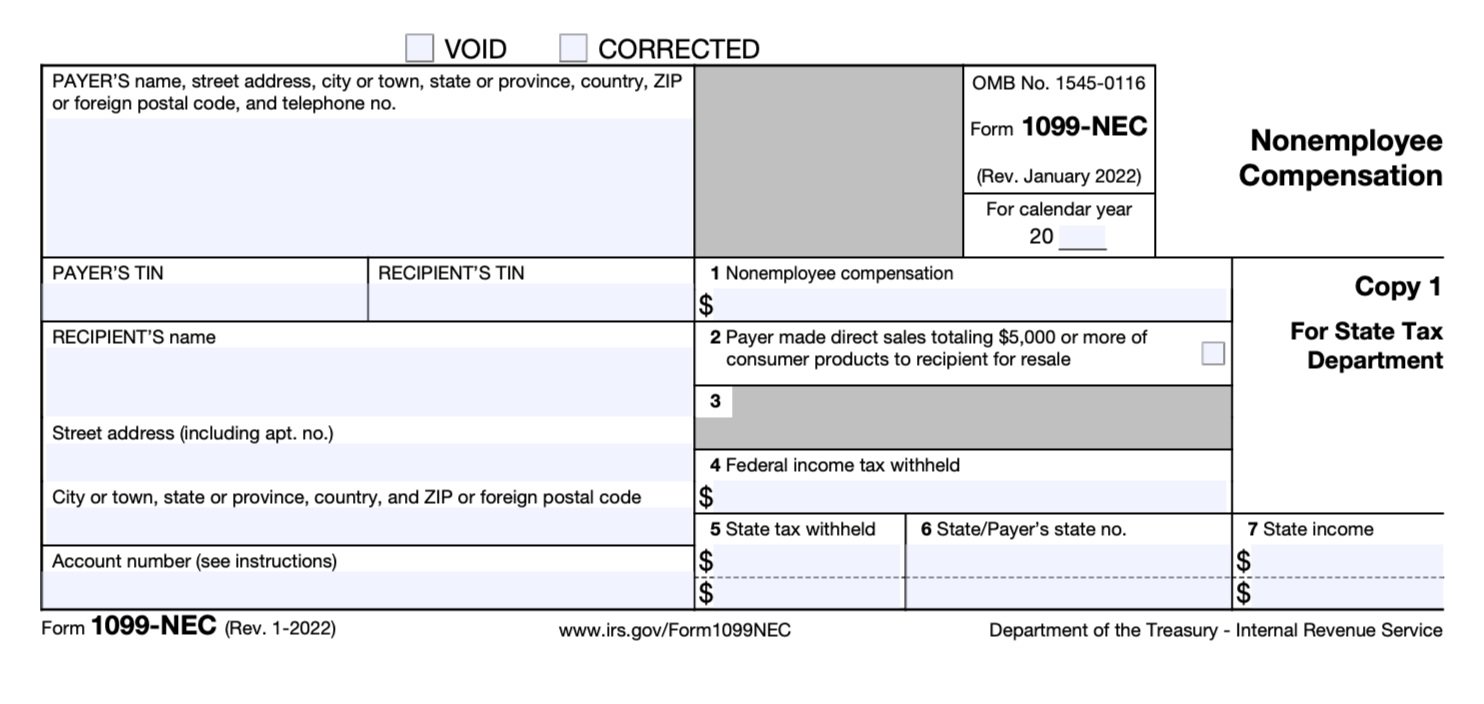

The most important box that you’ll use on this form is Box 1, titled “Nonemployee compensation.” This is the total you’ll use when calculating your business profit or loss on the Schedule C. This number will go on Part I, Line 1 of your Schedule C.

Keep in mind that you need to pay taxes on this income!

I spotted a mistake on my 1099-NEC. What now?

First, make sure you’ve double-checked that the total reported on your 1099-NEC in Box 1 equals the total amount of payments you have on record. To do this, you should add up all the money that was sent to your bank account from this company. This should match what your 1099-NEC shows. If it doesn’t, reach out to the company quickly to have your form corrected.

Additionally, if the IRS sends a notice about underreporting on your 1099-NEC form due to the mistake you found, here’s what to do:

Respond within the amount of time allowed in the letter.

Provide an explanation as to why you reported a different amount of income on your Schedule C.

If you filed your tax return before your 1099-NEC was corrected, provide that as your reasoning.

Pro tip: It is best to not file your tax return until your 1099-NEC is corrected.

Seek a tax professional to help you through the process if you need further assistance.

Disclaimer: The information contained in this Guide is not offered as legal or tax advice. The U.S. federal income tax discussion included in this Guide is for general information purposes only and is not a complete analysis or discussion of all potential tax consequences that may be relevant to a particular individual. In light of the foregoing, each individual should consult with and seek advice from such individual’s own tax advisor with respect to the tax consequences discussed herein. Any information contained in this Guide is not intended to be used, and cannot be used, for purposes of avoiding penalties imposed under the U.S. Internal Revenue Code of 1986, as amended.