What Is Self-Employment Tax and Schedule SE?

A question our tax team here at Stride regularly receives is “What is self-employment tax?” Today we are going to answer that question for our members!

Why do I have to pay the self-employment tax?

When you’re self-employed, you are required to pay taxes on your income that are the equivalent of what an employer typically pays on behalf of employees for taxes. Because you don’t have an employer paying these taxes for you, it is your responsibility to calculate and pay them.

There are two parts of the self-employment tax.

Social Security: You will pay taxes of 12.4% on up to $142,800 of your business profit.

Medicare: You will pay taxes of 2.9% on your business profit.

In order to find out how much this actually works out to be in taxes you owe, you’ll need to fill out a Schedule SE when you file your year-end taxes.

Typically, you’ll first fill out a Schedule C form for your independent business to calculate your total profit (earnings - expenses = profit). The Schedule C is where you list all the awesome tax write-offs (like mileage and cell phone deductions) you’re entitled to as an independent worker! After you get an idea of business profit (or sometimes business loss in certain cases), you’re ready to use the Schedule SE to determine how much in taxes you’ll owe on that business profit.

If you want an easy way to keep track of the business expenses to fill out the Schedule C, download the Stride app.

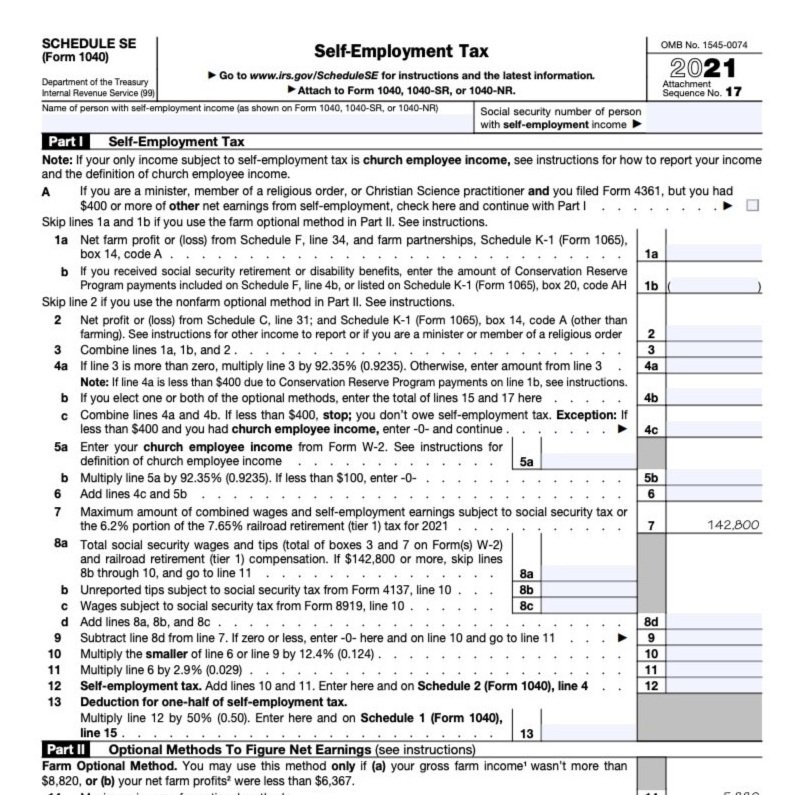

Filling out the Schedule SE

Next, you’ll need to fill out the Schedule SE. Note: there is no longer a Short Schedule SE available as a filing option.

Line-by-line breakdown of the Schedule SE, part 1

Line 1a: Net farm profit - This applies to farmers; it’s where they note their total profit or loss.

Line 1b: Social Security, Retirement, or Disability - Enter here the amount you’ve received from any of these programs.

Line 2: Net profit (or loss) from the Schedule C - Here is where you’ll write in the profit or loss from your Schedule C.

Line 3: Add it all together - This line is where you sum the numbers you wrote above.

Line 4: Calculate your tax obligation - This is where you multiply the line above (3) by 92.35% (.9235). If this amount is less than $400, then you do not need to pay any self-employment tax. Write the total amount after multiplying on this line.

Lines 5a-8d are less common instances that most people won’t have to fill out.

Lines 10 and 11: Calculate your Social Security and Medicare tax obligations

Line 12: Add lines 10 and 11 together to get your self-employment tax

Line 13: Deduction for one-half of self-employment tax - Multiply line 12 by 50% (.50). Enter the result here and on Form 1040, Line 14.

Yes! This line means you get to deduct one half of the amount you’ll pay for self-employment tax. This is deducted from your total taxable income that’s subject to the income tax (calculated on the 1040). This is where the IRS makes sure you pay a lower amount on overall income tax because of the self-employment tax you pay (as mandated by Self-Employment Contributions Act).

Remember to plug the final amount from Line 12 into your 1040. Once you’ve done that, you are done with calculating your self-employment tax!