Doordash 1099 Taxes and Write-Offs

Doordash is considered self-employment, which means you’ll pay taxes using 1099 forms. It also means you’re able to write off business expenses that could help you save on your tax bill.

Sound confusing? Don’t worry — we’re here to help make filing taxes as simple as possible. Read on to learn about what to expect when you file with 1099s, plus Doordash tax write-offs to be aware of.

The Basics

As a Dasher, you’re an independent contractor — in other words, Doordash is considered self-employment. You might Dash full-time or as a side hustle, but in the end, what this means is that Doordash doesn’t take taxes out of your paycheck automatically.

And because Doordash doesn’t take out taxes for you, you need to keep track of how much you owe in taxes based on what you’ve earned.

The key benefit of being an independent contractor is that you’re allowed to deduct lots of business expenses (like mileage, hot bags, etc.). The more Doordash tax deductions you take, the less money you’ll pay in taxes. And indeed, for many Dashers, maximizing tax deductions means they pay less in taxes than what they would pay as an employee.

Not sure how to track your expenses? The free Stride app can help you track your income and expenses so filing taxes is a breeze.

I Just Got My Doordash 1099. What Do I Do Next?

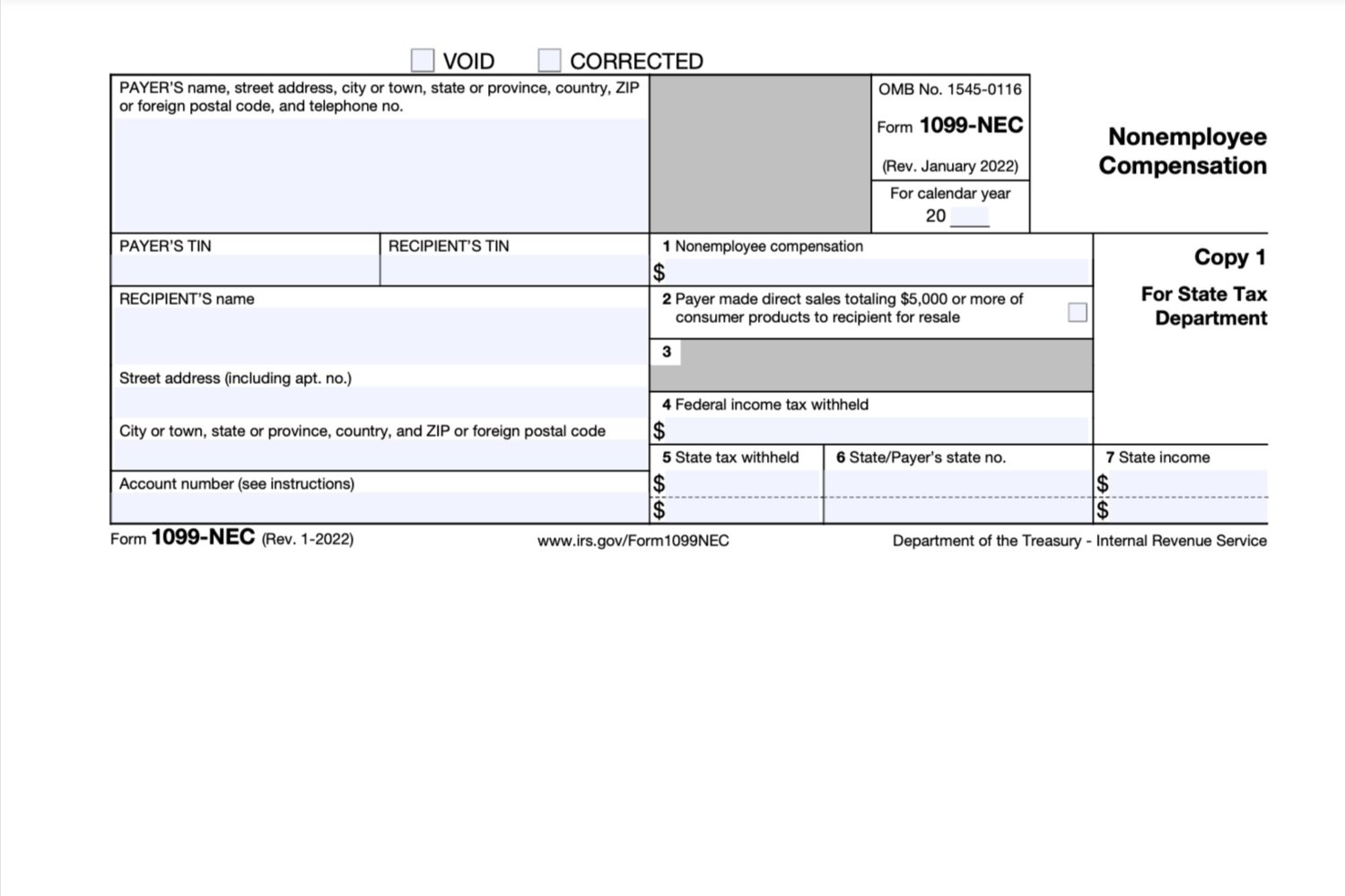

Doordash will send you a 1099-NEC form to report income you made working with the company. Typically, you’ll get your 1099 form before January 31. It will look something like this:

The most important box on this form that you’ll need to use is Box 7: “Nonemployee Compensation.” This reports your total earnings from Doordash for last year. The first step is to report this number as your total earnings. If you are:

Working with an accountant or CPA: Make sure they have a copy of your 1099 and also information about any tax deductions you’d like to make. We’ll discuss what deductions you can make below.

Using tax software like Turbo Tax: You’ll input your total earnings and any deductions you want to take, and the software will calculate what you’ll owe.

Doing your own taxes: You’ll input this number into your Schedule C to report “Gross Earnings” on Line 1. Also on the Schedule C, you’ll mark what expenses you want to claim as deductions. From there, you’ll input your total business profit on the Schedule SE, which will determine how much in taxes you’ll pay on your independent income.

Didn’t get a 1099? Doordash only sends 1099 forms to dashers who made $600 or more.

What Expenses Can I Write Off?

One of the benefits of being an independent contractor is that you can deduct many business expenses to pay less in taxes. Here are the business expenses you can write off:

Mileage

Because Doordash is considered self-employment, Dashers can deduct their non-commuting business mileage. This includes miles that you drive to your first delivery pickup, between deliveries, and back home at the end of the day.

Want to track your business mileage quickly and easily? Try the free Stride app.

Careful — you can’t deduct both mileage and gas at the same time. The standard mileage deduction (67 cents per mile in 2024) is calculated by the IRS to include the average costs of gas, car payments, maintenance, car insurance, and depreciation. Think of it like a bulk deduction for all of the costs you incur from using your car.

Fun fact: Taking the mileage deduction often means you can deduct more from your business income than you would if you had deducted all of your actual car expenses. This means you save more in taxes, and you don’t have to keep track of gas and maintenance receipts along with your mileage log.

Phone and Service

Every on-demand worker needs a great phone, accessories, and data to get through the day. And the portion of these expenses that you use for Doordash work counts as a tax write-off.

Phone accessories like a car holder, car charger, and any others that are “ordinary and necessary” for your delivery job are also deductible.

Here’s the catch: You can only deduct the expenses as a percentage of business use. What this means is that if you use your cell phone for work 50 percent of the time and for personal reasons 50 percent of the time, you could deduct 50 percent of the associated costs.

We know it can be tough to estimate how much of your phone usage is due to work. It’s probably best to go through your phone records for a typical month, look at how much of your data and phone calls are occurring during work hours, and apply the average to the rest of the year (or even better, check out your phone records each month).

Health Insurance

The IRS allows you to deduct your health insurance premiums if you’re self-employed and if you meet a few requirements. Learn about deducting health expenses.

Note: If you’re getting a government subsidy on your health insurance, only the amount you pay out of pocket each month is deductible.

Don’t have health insurance? Now’s the time to sign up for coverage for 2024. Four out of five people qualify for plans under $10, and you can write that off as a business expense at tax time. Enter your zip code below to start comparing plans.

Hot Bags, Blankets, and Courier Backpacks

Those insulated bags and blankets that you use to keep food orders warm? They’re deductible as an “ordinary and necessary” business expense because Doordash is self-employment.

Tip: The same “percentage of business use” rule applies here. The IRS can be strict about using business supplies for personal reasons. So if you’re in need of a hot bag outside of work, you would do better to have another bag for private use.

Tolls

Any toll fees that you pay while working are tax-deductible. Just make sure they're not already being reimbursed to you.

Parking

Sometimes you have to pay for parking in the city while working. That’s tax-deductible.

One note: Traffic violations, speeding tickets, and parking tickets are not deductible because they’re incurred due to inappropriate driving, and not directly because of work.

Inspections

If you’re required to get a vehicle inspection or a background check because of your delivery job, the expense is deductible.

Roadside Assistance

Fees for AAA or other roadside assistance programs are tax-deductible.

However, take note of how much of this expense is being used for work. For example, if you use your subscription twice in a year while you’re driving for work and once while you’re driving for personal reasons, take care to only deduct the portion of the expense that covered you for work. You could use your business mileage log to figure the business/non-business mileage ratio for your car and apply that ratio to find the deductible portion of your AAA membership.